Special offer

Best offer

year

€19

For 1 year

Choose now

Monthly

€1 per month

For 6 months

Choose now

Special offer

Best offer

year

€11.99

For 1 year

Choose now

Monthly

€2 per month

For 12 months

Choose now

Special offer

Read the article and the whole website ilmessaggero.it

1 year for €9.99 €89.99

Or

€1 per month for 6 months

Automatic renewal. Turn off whenever you want.

- Unlimited access to articles on the site and app

- 7:30 Good Morning Newsletter

- Ore18 newsletter for daily updates

- Our signature podcasts

- Insights and live notifications

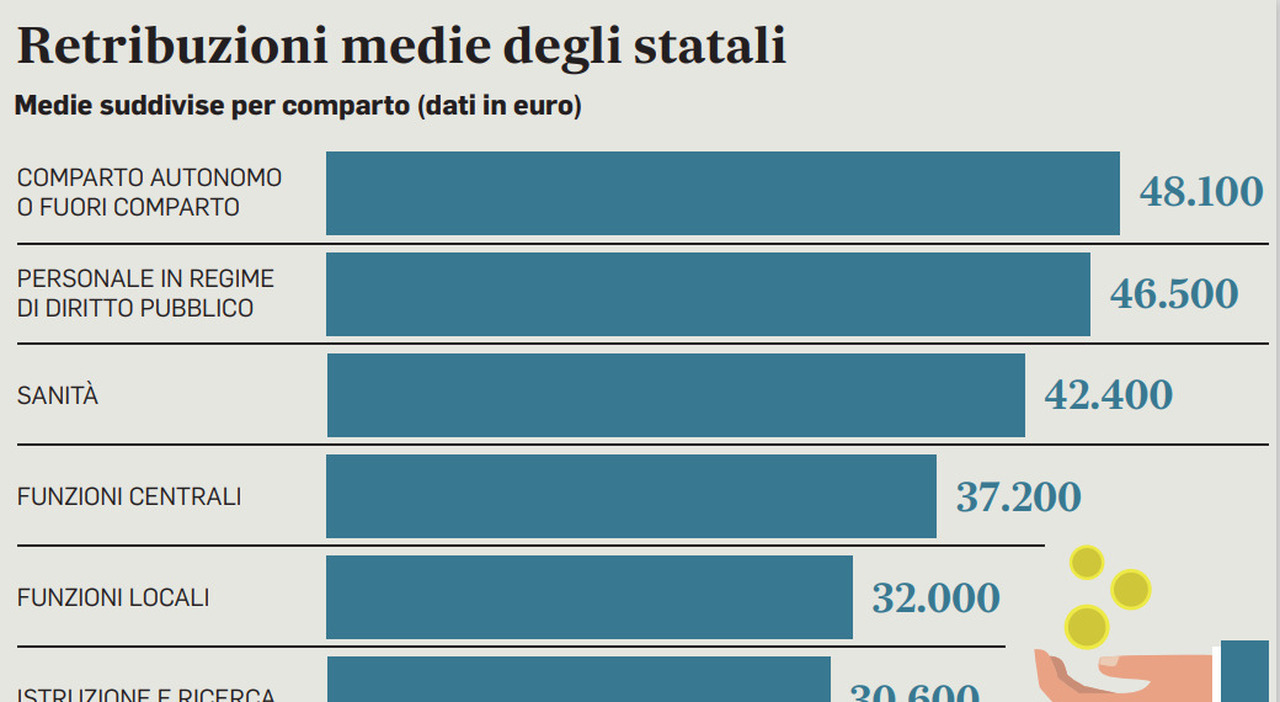

project Government Payment should be expedited liquidation of Government employees It is already in the technical table. And it is subject to political conflict with a view to the next budget maneuver in a few days. Settlement, again, must go through the banking system. There will be an idea Confirm to some extent the existing mechanism of prepayment of service final payments by banks, but ensure that the State bears the interest. But let’s go properly. A month ago, the Constitutional Court declared “inadmissible” the appeals submitted against the delay of severance pay for civil servants, which, in case of early retirement, lasts up to 5 years after leaving the job. However, the counsel scrutinized the provisions allowing deferment of severance pay to government employees and ruled that it was contrary to the constitutional principles of “reasonable pay”, which should only be adequate. “correct time”. And for this Constitutional Court He asked the government and Parliament to intervene, the judges said, to ensure that the severance pay of civil servants is immediately collected from the lower-middle wage earners.

State liquidation, INPS releases TFS advance but charges interest. Payments from July onwards

Paragraph

This is not a simple intervention for the government. Pay immediately tfs For all state employees, as per INPS figure, a The cost is 14 billion euros. It will be difficult to maintain, especially when the restrictions of the European Stability Pact return next year. But they also know that civil servants must be given an answer between Palazzo Chigi and the Treasury. So, thanks to the contract with API, but by making it “free” to the state, we started to read the bank advance as it already is today. How? The solutions They differ in studies.

Meetings

In the week commencing Monday 24 July, the Treasury Minister will keep the debate alive Giancarlo Giorgetti He will meet with his government counterparts, starting with Paolo Sangrilo, the head of the public ceremony, and the head of the Marina mission. Cauldron, to draw up a plan for the next budget maneuver. In fact, the Constitutional Court ruled that TFS’s banking progress was not decisive. But for the government, this would be an initial bridge solution. It is also possible that zero interest is only for the lowest income earners and not for all government employees. Already today there is a limit on bank advances for liquidation. According to the agreement with the banks, the limit of 45,000 euros cannot be exceeded.

Meanwhile, the legal battle End of service treatment can continue. Confesl-Unsa, a union that has been fighting for immediate payment of liquidation payments for years and has twice taken the matter to counsel, has announced it will also appeal to the European Court of Justice. “This”, General Secretary Massimo Battaglia tells Mezzagero, “until the government finds a solution capable of allowing immediate payment of the final benefits of the service to all employees”. And for Battaglia, bank advances would be a “satisfactory” solution if the workers didn’t have to pay any interest.

Read the full article

In Messenger

“Gamer. Professional beer expert. Food specialist. Hardcore zombie geek. Web ninja. Troublemaker.”

More Stories

Worry about him – Il Tempo

“China Uses 'Boiled Frog' Strategy, Becomes More Aggressive”

“We are the first force of the European center-right, so we arrive safely at the end of the assembly” – Corriere.it