Part of the salad stands out clearly in the picture. But the main path is actually in the tables and figures that follow on the following pages. These are the accounts of an anonymous restaurant, and it appears that the income to be included in the next declaration will be 15,418 euros. But according to estimates taxIf the restaurant owner really wants to comply, he will have to file a declaration of €39,365. what is he talking about? It's one of the first Simulation of the biennial safeguard agreementthe “agreement” that will be proposed for 2.7 million VAT numbers And companies with income up to 5 million that will have to accept or reject by October 15 this year.

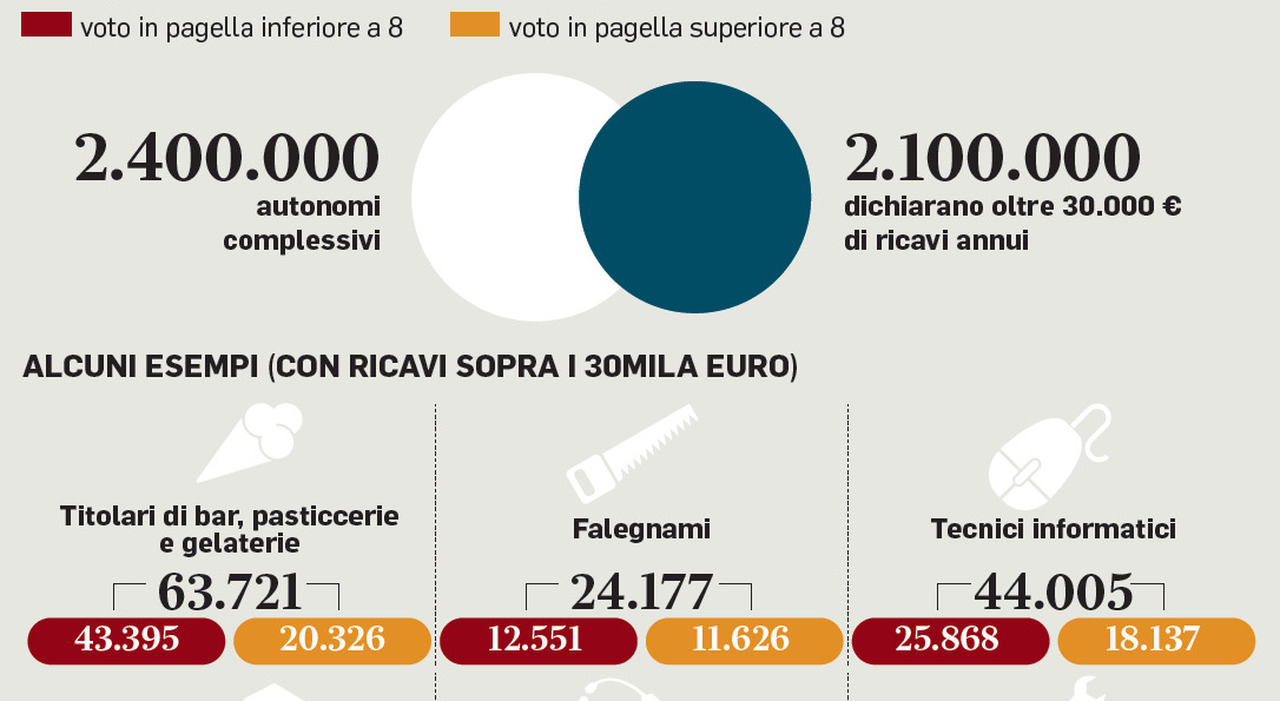

But if they reject the tax authorities' proposal, they will end up on something like a blacklist of activities that will be subject to more stringent controls. Those who accept will receive a series of benefits, such as stopping tax assessments and faster tax refunds. A few days ago there commission The experts responsible for defining the technical aspects of this measure, with the strong support of Vice Minister of Economy Maurizio Liu, included in the tax reform, delivered the final document. There is a fair amount of news. The first is that VAT numbers They will have two years to “align” with the expectations of the tax authorities. In this time period, they will all have to achieve a score of 10, the maximum, on synthetic reliability indicators, the report cards provided by the tax authorities for VAT numbers.

The second new thing is that Score 10 must be achieved in two equal “instalments”: half in 2025 and the other half in 2026. Let’s take the example we started from, that of the restaurant owner. To be compliant, it must rise from €15,400 to €39,400 within two years. This means 24 thousand euros of additional income that must be declared. Of these, twelve thousand will “appear” in 2025, and another 12 thousand in 2026. In short, the effort will not be indifferent. It should be considered that the example mentioned in the documentation Expert Committeetakes into account the restaurant owner who has a reliability index of 6.15, in short, complete satisfaction.

Another reported example is an accountant, expert or labor consultant with a turnover of just over 70 thousand euros.

the passage

There is also another aspect to take into consideration. Even those who have today A perfect ten on the report cardIt will have to declare something more to the tax authorities in 2025 and 2026. Why? To take into account the economic trend. If the country grows, obviously revenues are expected to increase as well. This increase is tentatively set at 0.6 percent for 2024 (2025 tax return) and 1.1 percent in 2025 (2025 tax return). tax declaration for the year 2026). Thus, for example, a clothing store with revenues of 444 thousand euros, which has ten in the tax report, must declare 57,124 euros next year, while the tax authorities in the biennial safeguard agreement will ask it for 58,157 euros, i.e. Nearly a thousand euros. More euros than usual spread over two years (this is another example contained in the work of experts). As mentioned previously, the tax office's proposal must be accepted or rejected by October 15. History is not a coincidence. In a few days, the government will present its budget. The resources that will come from the agreement will end up in the “tax cut” fund, the piggy bank created to finance fiscal delegation measures, starting with the IRBV cut. Reaffirming the three rates next year would cost $4 billion. But the government also intends to introduce a new form, namely a tax reduction for the middle class, those who declare income up to 55 thousand euros. In short, the next tax cut is also linked to the success of the agreement.

© All rights reserved

Read the full article on

Prophet

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

Jaecoo J7 and J8 Plug-in: also coming soon in Italy

Super Bonus, Paragon: That “monster” that not even Draghi wanted to stop

IRS Shock: Goodbye Tax Bills, They'll Take Your Money Straight From Your Account