Milan, December 3, 2021 – tables. mathematical calculations. bows. rates. Personal income tax calculator. It seems that everything is over. But maybe not. Or at least not completely. In the morning, in fact, the idea arose to “freeze the cut in income over 75 thousand euros” for a year or two. This is the hypothesis put forward by Prime Minister Mario Draghi in the control room and I refer to the leaders of CGIL, CISL and UIL. Recovered resources will go to Solidarity Fund for Low Income High Bills: Allocates 280 million euros At the bottom.

on the scale However, there was no political agreement So much so that the Cabinet, which was discussing this particular measure, must stop. In particular, for Taksim – center-right and IV on the one hand, Pd, M5S and Leu on the other – the solidarity contribution, for 2022, to personal income taxes of more than 75 thousand euros, which will not benefit from the reduction in study for freedom 250 million euros To be used in the face of high bills. Another breaking point, is 1.5 billion one-time contributions Which, in the agreement between the parties reached at Mef last week, would have meant Employees less than 47 thousand euros of income, while in these hours – thanks to the wall erected by the trade unions – consideration is being given to lowering the bar from 35 thousand euros of income decreased, which narrows the public to intervene in favor of the weaker groups. but It seems that the proposal is set to remain a dead letter.

Draghi’s proposal, however, has been rescinded Because of the opposition of part of the majority. Personal income tax rates will remain as stipulated and the funds to “help” the less wealthy (in particular to deal with expensive bills) will be found in another way.

Solidarity’s contribution was cancelled, but Mef technicians found in the folds of the budget, between savings and money not fully spent, About 300 million to interfere with bills without burdening taxpayers. looking at i 500 million euros of “treasure”., the availability of eight hundred million has been reached. On the other hand, the distribution of the eight billion envisaged in the maneuver to cut taxes does not change: seven will go to the reform of the IRPEF, and one will go to the IRAP cut for the self-employed. Instead, what could be subject to changes is the way resources will be distributed, with more emphasis on lower incomes than on the initial plan. “The meeting point is to improve the file for the distribution of the maneuver, and also to take into account the demands of the unions,” said Deputy Minister of Economy Maria Cecilia Guerra (Leo).

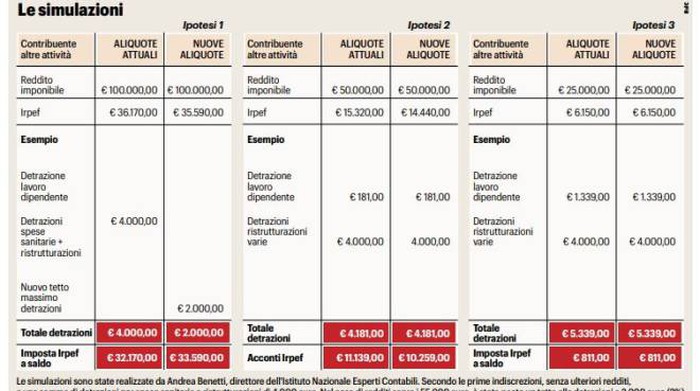

What are the effects of a paycheck every month The new personal income tax? tables viscoco translate the new rates Created by the government in additional monthly entries. A series of simulations useful for understanding a difficult subject in itself, the tax reform of 7 billion euros was used to reduce two tax rates (from 27 to 25% and from 38 to 35%) and abolish the 41% that will be replaced by 43% starting from the total of 50,000 euros annually. However, Italians want to know how much money they will make each month, and the answer will make especially happy people High average income. Let’s see together the data by income.

What will the actual impact of the new personal income tax rates be on Italians’ payroll? There are many factors that affect schedules viscoco try to translate the new rates Created by the government In (average) additional monthly income

For the lowest incomes, amounting to 15 thousand euros per year, there will be no difference in 2022 from the previous year. That’s at least according to simulations conducted up until the last few days. This is amazing The band can actually benefit from the fund resulting from freezing IRPEF cut income above 75 thousand euros. However, with regard to the numbers involved, it is still too early to formulate hypotheses.

Modest economic benefits for this category: only 8 euros more per month, which is halved to 4 for those who do not exceed 17,500 per year

In this case, the monthly income can be measured by 17 euros which became 22 euros For those who declare 28,000 euros.

As income increases, so does the “bonus” defined by tax reform that translates into this bracket 27 euros per month becomes 39 euros per month for those earning up to €35,000 per year.

In the upper range, the increment becomes equal to 52 euros per month. For those who earn up to 45 thousand, the benefit is 52 euros per month.

The lucky ones with an annual income of 50,000 euros will get the biggest benefits: +77 euros per month

From this range begins the decline of the curve: +56 € for income up to 55 thousand €; +48 euros for income up to 60 thousand euros; +39 euros for income up to 65,000 euros; +31 € for income up to 70,000 €, finally until the last hours, +23 EUR for income from 75,000 to 500,000 EUR, the participation that would have been frozen with the Solidarity Fund but instead in view of the recent effects will not be altered by going to withdraw these funds from Other savings in maneuver.

Current IRPEF:

Rate………………………………Income Segment (Euro)

23% ………………………… up to 15,000

27% from 15,000 to 28,000

38% ……………………………. From 28,000 to 55,000

41% of 55,000 to 75,000

43% …………………………..more than 75,000

The future of IRPEF:

23% ……………………………. up to 15,000

25% ……………………………. 15,000 to 28,000

35% ……………………………. From 28,000 to 50,000

43% …………………………………. more than 50,000

© All Rights Reserved

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

Tesla Cybertruck European tour begins. Here's where to see it in Italy

Italy raises nearly two billion euros: it's a record, what happened

If you still have those old 10 lira, you're in luck: here's what they're worth