The only certainty is that AirBnb has turned into municipal vaults worth 5.9 million euros collected as city tax. But how many visitors have already paid, how many nights and for what kind of tourist facilities, and whether the paid figures, above all, are correct, no one knows. Not only does Capitol know that it has not only opened a dispute with the short-term rental giant, but is willing to take it to court and have asked the Board of Auditors to step in for fear of tax damage.

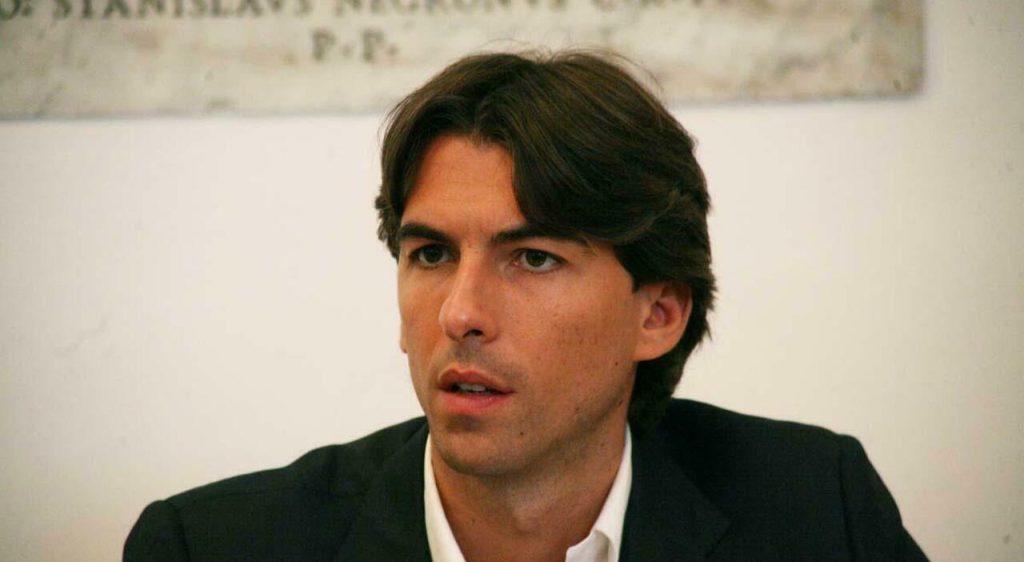

In this regard, tourism and major events consultant, Alessandro Onorato, does not hold back: “It is unacceptable that Roma Capitale does not know what the money Airbnb pays in the Capitoline coffers indicates. No one ever checked what he was paying for. The tax damage is tangible and totally unfair compared to hotels which rightly have to report the number of nights spent, the number of guests and the level of the building.” The bottom line: “In fact, two years ago it was impossible for management to verify the correctness of the payments.”

Depending on the dispute, the protocol was signed in 2020 by Airbnb and the Raggi junta hoping to raise up to 20 million annually (estimate based on pre-Covid flows). The platform not only agreed to collect the tourism tax (3.5 euros for bed and breakfast) from tourists, but also ensured that all data related to rentals was communicated to the municipality. Information that high-tech giants are always reluctant to provide for fear of tax disputes. But Commissioner Onorato, who had just taken up his position in the Capitol, discovered that the multinational had never provided these items and began a battle – Italy’s first municipality in this direction – to rebuild the former municipality and, if necessary, get due. “Also because – he notes – AirBnb doesn’t always act as an intermediary for apartment rentals, there are other types of structures that have to pay more than tourism tax.”

With this in mind, the agreement, which has expired and is now in effect, was not renewed. Instead we started with the stamped paper. On October 14, for the first time, the Directorate of Procedures for Tax Revenue in the Municipal Economic Resources Department asked AirBnb for clarification. On December 31, the same office sent a report to the Audit Bureau. Between January and February, the call to start an administrative procedure preceding the ordinary courts began, and adjudication began on the agreement.

Il Messaggero asked the AirBnB group to respond, but did not receive a response. The group has until February 28 to file its deductions with the municipality. Onorato, for his part, said that he was “ready to renew the protocol: I have nothing against AirBnb and their application. But first we have to clarify and, if necessary, remedy the previous one.” It is no coincidence that the commissioner has already asked the Tourism Department and the Department of Economic Resources to activate Contractual verification procedures in addition to the application of any penalties as specified in Article VIII of the Convention referred to in the subject matter.

Orders

Therefore, the issue is first of an organizational nature and then of a financial nature. In the note sent to the Court of Accounts, the Department of Economic Resources notes, in addition to specifying the amount that Airbnb paid from the first quarter of 2020 to the third quarter of 2021 (that is, about 5.9 million euros), that the company “did not” to communicate, as It is required by regulations relating to the matter and by the same agreement, in daily attendance, with special reference to the name of the structure, complete with an identifier certifying the administrative regularity of the activity, the number of guests managed, the nights, the rate applied and the “amount of contribution collected for each individual structure divided by quarters” .

This dispute directly affects hoteliers, who have been hit hard by the Covid crisis. “We are very pleased with the attention the Commissioner has devoted to this very important issue – comments Giuseppe Rossoli, President of Federalberghi Rome – the conditions must be created to be able to carry out checks on the tourism tax paid, in hotels at any moment the check may arrive, we record everything, For example, the exact address of the structures on the platform is not indicated.

© Reproduction reserved

© Reproduction reserved

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

IRS Shock: Goodbye Tax Bills, They'll Take Your Money Straight From Your Account

Perfect BBQ With LIDL Offers, your May 1st BBQ will be unforgettable: professional accessories at low cost

Income 2023, the highest in Marche in Nomana. Ascoli raises the rear – Current news – CentroPagina