we are here. We know it has been written several times in the past few days, but late last night everything that was missing was received to go forward next week with approval. ETF Bitcoin Spot. They should all begin, barring dramatic disturbances, on January 11th, early Thursday.

This is the sum of what actually happened and what happened Rumors Which comes from Washington and which no one denies. The rumors come from multiple sources and all converge towards what we just wrote. Yes, we are here. There is currently no possibility of rejection, although an old acquaintance in the world of cryptocurrencies and Bitcoin has tried again Hump shot.

On our country Telegram channel You can follow all this news live and often as a world premiere. You can also find all of my employees Cryptovaluta.itand our readers, to discuss cryptocurrencies and Bitcoin all day, every day.

Here we are: Latest updates Then we start with the Bitcoin Spot ETF.

Late yesterday evening, eleven updates arrived for the first of the two forms needed for approvalETF Bitcoin Spot. This is the form that the exchanges that will list the different ETFs must send: NYSE, NASDAQ, and CBOE, all of which took care to send an update simultaneously, which would have met no resistance from the SEC.

Now, at least according to what's coming out of the USA, we'll have to wait until 08:00 on Monday – Washington time – when all 11 sponsors (supposedly only Pando is missing, but that doesn't seem to interest many) To submit the other updated form, S-1.

It would then be up to the SEC commissioners to vote: a simple majority would be enough, which seems pretty clear at this point. In fact, the SEC's free decision is also affected by the ruling – the ruling in the Grayscale case – which will require applications not to be denied using arguments from the past.

Additionally, a lot has been done in recent weeks to create ETFs that are in line with what the SEC itself requires, starting with the method of creation. Creates cash Let's move next to the structure of the investment vehicle itself.

We are – and we say this without the slightest comfort – at the end of a very long story, one that has stretched back to the beginning of last summer and that has brought us to the front lines day after day. , always without Fake news We hope it can make you understand something more about a long and often unintuitive process.

We will start trading immediately, or at least that is the rumour

And it doesn't look like we'll have to wait long for trading to start, which according to rumors from Bloomberg's Eric Balchunas, will begin on Thursday, January 11.

So there will be no lag between a good listing and an actual listing that was suspected only a few days ago. As of Thursday, there may already be 11 ETFs desperately trying to accumulate Bitcoin.

Once again according to rumours, this time coming from VanEck, BlackRock is waiting for a few billion dollars for its exchange-traded fund, which will come – some have confirmed this – from entities that already hold Bitcoin cash. It is not clear at this time how true this is.

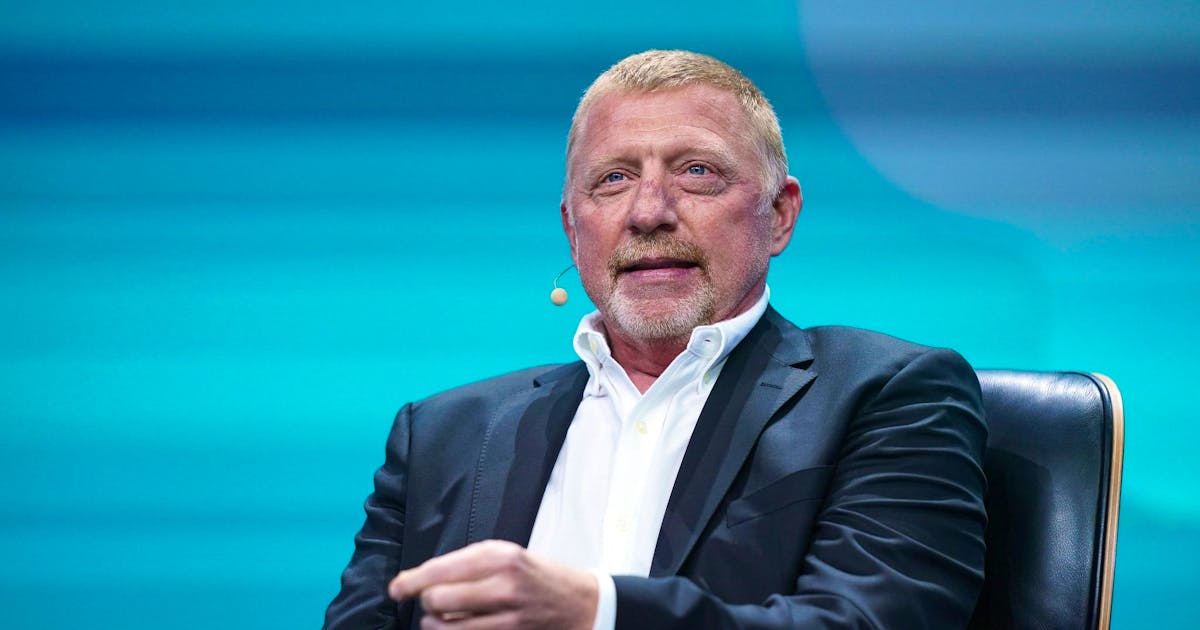

Elizabeth Warren's final teleprompter shot

Do you remember Elizabeth Warren? She is the self-proclaimed US Senator at the head of the anti-crypto army. Yesterday, amid general rejoicing, he tried to crash the party.

Let's go in order: l to request to Hashdex Comments are still open, or rather, were as of midnight last night. These are comments that may be submitted by the public or by companies familiar with the facts and which the SEC may or may not take into consideration.

It's almost over yesterday, the comments came in 100% negative from this guy Better marketsa type of association that aims to improve markets by pursuing an agenda consisting of environmental, social, governance, gender equality and other strong political issues. Marka Marka in the United States of America.

It's all legitimate, until you dig deeper into the site and discover that among the testimonials is Elizabeth Warren, who doesn't really want to see people freely deciding whether or not to buy Bitcoin, even if only through investment vehicles. It is very unfortunate for Elizabeth, who this time also seems on the verge of defeat.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

In Paterno, the average per capita income is €14,271

730: You can also deduct medical expenses for non-dependent family members, and many don't know this

Did inflation reduce Remini's savings? Interview with Mattia Bari (FABI) • newsrimini.it