What is the value of the global minimum tax on multinational corporations? The 15% tax on profits for large corporations, agreed by the G7 finance ministers, is 111 billion in 2021 alone for the European Union, the United States, Canada and Japan. For Italy, the annual income will be 2.7 billion. While the entire European Union would raise 48.3 billion, more than half of what the Commission hopes to raise together in the markets using redemption fund bonds (which, unlike taxes collected, are money we will have to pay back sooner or later, with interest). This is what the newborn thinks European Tax Monitor الضرائب in one studio On the impact of the potential joint minimum tax on earnings.

who earns it

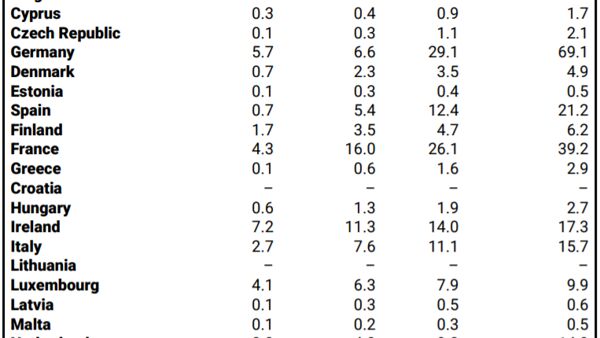

The study evaluates three possible scenarios, also in response to criticism that always accompany proposals for higher taxes on multinational corporations, that such tax increases would cause capital (and jobs) to flee from the country that implements them for them. which instead imposes lower tax burdens on large corporations. Precisely for this reason, there have been discussions for months about a “global minimum tax” among countries that adhere to the OECD. This minimum tax on profits on a global scale is the first scenario the study takes into account: With a minimum global tax of 21% (the original US proposal of the OECD), EU countries will raise about 98 billion in 2021 (Italy 7.6) . With a 25% tax, it would rise 167.8 billion for the entire European Union (of which about 11 for Italy). Finally, with a 30% tax, the figures shown at the beginning will be reached (269.7 for the EU as a whole, 15.7 for Italy). At the moment, if the agreement with the G7 is confirmed, the study’s expectations are that the 27 EU countries will raise 48.3 billion euros. For the United States, the general tax will bring in 40.7 billion, while Canada and Japan will bring in 16 and 6 billion, respectively.

These resources will come from taxes levied on its multinational corporations: in fact, each country will apply minimum taxes to large corporations and banks headquartered in its territory. Any race abroad in search of a more generous tax would be abolished under the international agreement. But the advantages of those who apply the minimum tax to profits will also be found in the premise that we move unilaterally, according to the study. This is the hypothesis addressed in the other two scenarios.

On the other hand, the researchers tried to find out what would happen if the European Union implemented its own minimum combined tax of 25%, without an international agreement. In this case, the plunder of EU countries would increase by 30 billion (compared to the hypothesis of a global agreement at a rate of 25%), which would be the additional revenue from additional taxes paid by non-EU multinationals such as Amazon. or Google. , For example. Yes, because one of the first clichés that the study attempts to deconstruct is that giants of the United States or other parts of the world are the ones who benefit from the EU’s financial far west: “For the EU as a whole, we would have much higher potential income from the increase in corporate taxes EU taxation of companies outside the EU – reads the study – if they want to generate significant resources, for example to pay the cost of the Covid-19 pandemic, so it is essential that the EU focus on its multinational companies.”

How much will Eni and Unicredit pay?

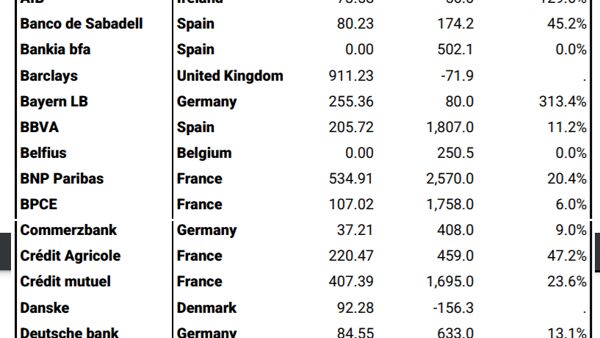

Who i am? The study makes some names and surnames. For example, with a 15% tax, Dutch oil giant Shell will pay 1.3 billion in taxes on its profits. The large German insurance company Allianz will pay 286 million euros to the Berlin treasury. Italy can also count on its national giants: from Intesa Sanpaolo, the company calculates revenue of 40.1 million euros, while another 72 million will come from Unicredit’s profits. Even the major Italian energy companies will make their contribution: Enel with 57 million, Eni with 63.

These numbers, according to the study, will not only show that the EU can act on its own in trying to get multinationals and banks to pay what many call a fair share of taxes. But also individual European countries can impose an increase in national taxes on profits that have more advantages than losses. According to the study, in fact, if an EU country acts as a “first mover”, it can collect additional taxes of up to 70% on the profits of domestic and foreign multinationals. The researchers suggest that it would be better if this measure was also coordinated with a few member states, in the absence of an EU-wide agreement. Going first, according to the thesis espoused by the company, will not lead to capital flight, but rather to a “race to the top” in other countries, European and non-European. “Our analysis indicates that refusing international coordination is not a sustainable position” in the long term, the text reads. If the European Tax Observatory thesis is confirmed, Italy could earn around 14 billion in 2021 with a 25% profit tax.

Gallery

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

IRS Shock: Goodbye Tax Bills, They'll Take Your Money Straight From Your Account

Perfect BBQ With LIDL Offers, your May 1st BBQ will be unforgettable: professional accessories at low cost

Income 2023, the highest in Marche in Nomana. Ascoli raises the rear – Current news – CentroPagina