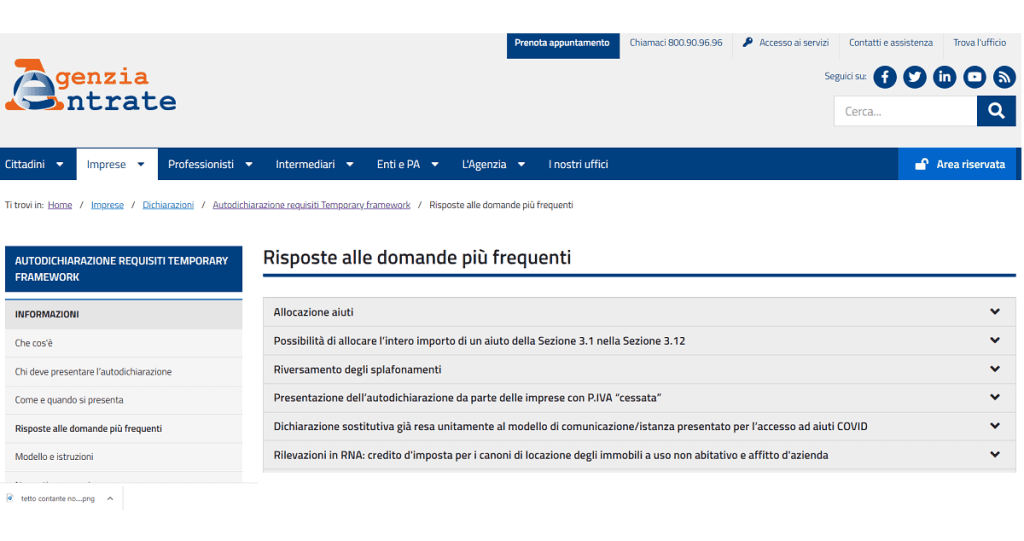

State Aid Self-Declaration, From Errors to Calculating Ceilings: With Frequently Asked Questions, and Answers to Frequently Asked Questions, published November 17, 2022 The Revenue Agency arrives with new instructions on compliance that expire November 30.

Approaching Self-declaration for covid country aid expiresscheduled in November 30, 2022. give it Errors to me ceilings calculationThey arrived from the Revenue Agency New instructions with instructionsAnswers to Frequently Asked Questions, posted on November 17.

Flexibility Ways to return any excess amounts And to allocate the amounts benefited from, and also commitment to VAT figures have been finalized And the one term To modify data already sent: These are the main explanations given to companies and individuals who have benefited from it emergency measures set forth in the Restart Ordinance onwards, which fall within the so-called parachute systemand you must follow up withinvestigation, achievement.

Frequently Asked Questions Self-Declare Covid State Aid Errors must also be corrected by November 30th

Timing is still off-axis forCovid State Aid Self Declarationon distance Less than two weeks before the deadline They arrived questions and answers that clarify and deepen Instructions already provided for binding subjects.

Again, as forAcceptance of the simplified form Arrived late, it must be said: Better late than neverAgo Answers to frequently asked questions highlight a number of relevant aspects.

I over all times for respect and the Required subject audience.

next The extension was approved in JuneL’Covid State Aid Self Declaration must be sent By November 30th.

In case errors or inaccuraciesit is possible until the same date to make a file Introducing the new which replaces the previous one. The same methods and term can also apply if you choose to use Simplified modelavailable from October 27 last year.

FAQ – Covid State Aid Self-Declaration, also mandatory for no longer active VAT numbers

However, in connection with audience of interested parties The aforementioned large-scale font has already been confirmed many times before The Ministry of Economy and Finance: The obligation to submit a self-certification is linked to Use the help of the so-called comprehensive schemewhich does not decompose even in the case of la Close the VAT number.

On the other hand, interpolation is also useful for verifying the need to proceed with returning the amounts received Over the ceilings established by the temporary framework.

with the This FAQ was posted on November 17, 2022The revenue agency also explains:

“In particular, on the premise of stopping the value-added tax number of the company – in line with the provisions, regarding declarative obligations, of Article 5 of Presidential Decree 322 of 1998 – it is considered reasonable to assign the burden of presenting a self-certification to the liquidator or to another director.”.

The The task of making payments In any case, it is the responsibility of the members.

Covid State Aid Self-Declaration, Useful instructions for calculating ceilings

And he is right Aid reimbursement In case Going over the ceilings and on verification mode New important indicators appear, unlike what happens to Required subject audienceLeave the door open for flexibility.

Limits to be respected Sections 3.1 and 3.2 of the provisional framework Covid-related changes over time.

First, it is clarified

In the presence of the requirements to access Sections 3.1 and 3.12, the professors For the taxpayer, who has benefited from the assistance of the comprehensive scheme, to chooseAllocating assistance more in line with the individual’s situation also certifies, in the self-declaration, compliance with the additional terms set forth in Section 3.12 aforesaid, also in respect of the full amount of assistance received”

But when it is not possible to move on Move from one section to anotherfor lack of requirements, and it happens a roof overrun established within a certain period of validity of the hudud, Undue excess capacity can be found, incl recovery interestwithin the new and different roof of the same section, not entirely covered.”.

A less stringent approach is also confirmed with regard to Reversal of aid amounts outside the overall scheme If the limit is exceeded.

The general rule is that it should be observedChronological Which with various aids (both those under “parachute system” All of those who do not fall under it) have been and will be registered with RNA, SIAN, and SIPA. But the revenue agency explains:

For those who have benefited from at least one of the aids in the CD. So the “comprehensive system” stays there The ability to assess their own situation Taking into account also the enrollment in RNA, SIAN and SIPA that may have already taken place by other donor administrations and the concrete possibility of returning ‘other assistance’ to the appropriate administration”.

All answers to frequently asked questions can be found on the Agenzia delle Entrate page dedicated toCovid State Aid Self Declaration.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

Super Bonus, Paragon: That “monster” that not even Draghi wanted to stop

IRS Shock: Goodbye Tax Bills, They'll Take Your Money Straight From Your Account

Perfect BBQ With LIDL Offers, your May 1st BBQ will be unforgettable: professional accessories at low cost