Household debt is increasing and the risk of usury is imminent On craftsmen and small entrepreneurs. Italians are increasingly having to ask for loans from banks, so much so that they come to an average amount per household of €22,710. This was revealed by the Mestre Cgia Study Center, which calculates how the volume of debt in our country has reached a record high of 595.1 billion euros, an increase of 3.5% compared to 2021.

analysis

CGIA experts in the analysis argue that the increase in the stock of bank debt is the result ofInflation, higher mortgage rates, and higher utility billsas well as underpinning the strong economic recovery that occurred in the 2021-2022 biennium, after the end of the Covid-19 lockdowns (we talked here about rising mortgages and how to pay them off while we were here explaining the risks to mortgages associated with the tax on extra earnings).

The latter factor is linked in particular to an increase in debt among the provinces with the highest levels of income: these regions of the country located mostly in northern Italy are, according to the study, the most exposed and “the greater debt of these regions could be attributed to the large investments made in the years The latter is in the real estate sector which is obviously mostly attributed to the families that have Good standard of living. (Here we have explained what genetic debt is and when it is identified.)

In this context, although CGIA experts talk about a “critical situation but not out of control”, the study center of the association focuses attention on Risk wear which may result from an increase in indebtedness, considering it “necessary to encourage recourse to a ‘prevention fund’ against usury. A tool, the latter, introduced by law a few decades ago, but also of little use because it is unknown to most people and, therefore, with the scarce economic resources available “.

most indebted provinces

According to CGIA analysis, the county with the highest home debt is MilanWith an average debt of 35,342 euros (+5.1 percent compared to 2021), it follows in second place Monza Brianzawith 31,984 euros (+3 percent) and has been in third place ever since By weight, by 31,483 euros (+5 per cent). At the foot of the platform are families of Rome and the county, with an average debt of €30,851 (+2.8 per cent) and families of Como, with €30,276 (+3.8 per cent).

Contrary to the arrangement, we find an arrangement among the provinces that are less indebted Agrigentowith a debt of €10,302 (+3 per cent) and debt Phoebe Valentia, with 9,993 euros (+1.9 percent), respectively third from last and penultimate. While the households with the least debt are a Innawith an average “red” of 9,631 euros (+3.6 percent). In 2022, the Italian province with the greatest variance of growth in household debt was Ravenna (+9.1 percent), while the only province to record a decrease was Vercelli (-2.3 percent).

Here are the top 10 positions in the ranking Most of the city’s provincesThe first number indicates the total household debt in millions of euros in 2021, the second calculated in 2022, while the last number represents the percentage change between the two years:

1 – Milan: 915 51; 54,567; +5.1

2 – Monza – Brianza: 11843; 12,195; +3.0

3 – Bolzano: 6894; 7237; +5.0

4 – Rome: 174 59; 60,848; +2.8

5 – Como: 7,662; 7952; +3.8

6 – Prato: 3023; 3201; +5.9

7 – Florence: 12 882; 13426; +4.2

8 – Varese: 10946; 11249; +2.8

9 – Siena: 3271; 3419; +4.5

10 – Honors: 2724; 2767; +1.6

Here instead of the last 10 posts between The least indebted provinces in ItalyThe first number indicates the total household debt in millions of euros in 2021, the second calculated in 2022, while the last number represents the percentage change between the two years:

98 – Caltanissita: 1208; 1,243; +3.0

99 – Isernia: 402; 420; +4.3

100 – Benevento: 1.242; 1,295; +4.3

101 HP: 1,686 HP 1733; +2.8

102 – Crotone: 760; 782; +2.8

103 – Cosenza: 3260; 3345; +2.6

104 – Reggio Calabria: 2,329; 2376; +2.0

105 – Agrigento: 1,755; 1808 +3.0

106 – Vibo Valentia: 632; 644; +1.9

107 – Ena: 643; 666; +3.6

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

In Paterno, the average per capita income is €14,271

730: You can also deduct medical expenses for non-dependent family members, and many don't know this

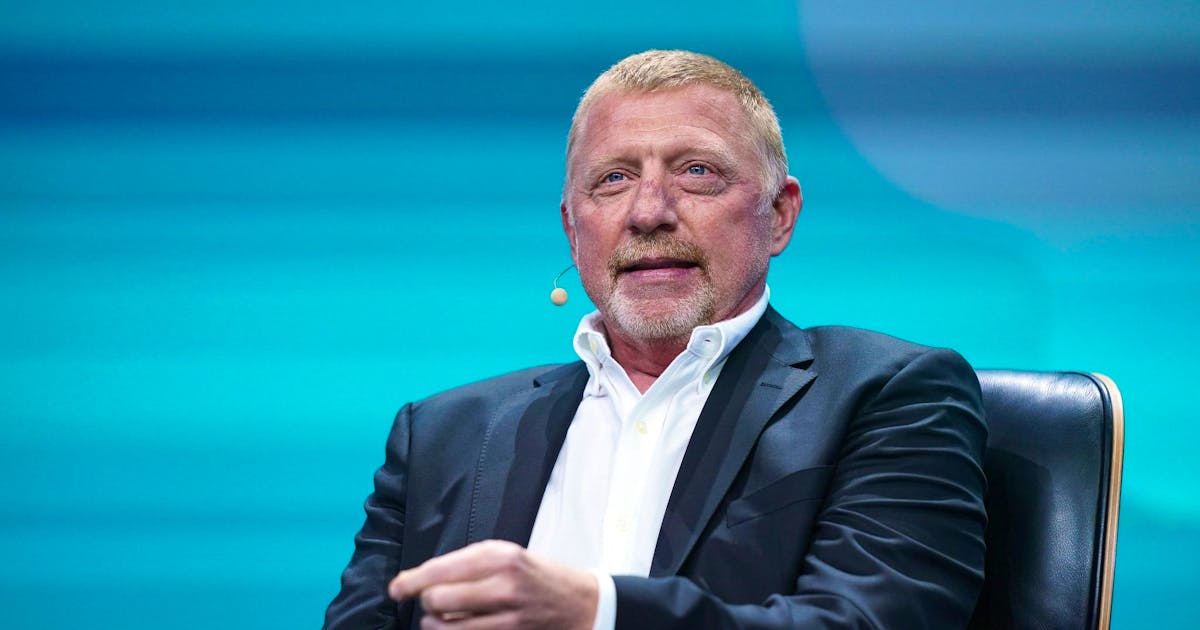

Did inflation reduce Remini's savings? Interview with Mattia Bari (FABI) • newsrimini.it