Milan, July 6th. (askanews) – The challenge is ambitious: to make the Italian economy more innovative, digital and above all sustainable. In order to support the investments of Italian small and medium-sized companies in sustainability, innovation, digitization and – to a lesser extent – in the sectors of culture and creativity, the guarantee of 110 million euros is provided by the European Investment Fund of the Bper Banca Group, which also includes Banco di Sardegna. The agreement, signed at the Bper office in Milan, will allow the banking group to create a portfolio of loans secured by an EIF of a maximum of 240 million thanks to the multiplier effect:

“The effect of leverage will usually help us support small and medium-sized companies, so we are talking about small and medium-sized companies, and therefore with an average cut in financing we imagine that it can somehow contribute to about 2,500 to 3,000 companies – explains to Askanews Stefano Vittorio Kuhn, Head of Commercial and Retail Banking at Bper Banca – the logic is precisely to give a strategic direction towards ESG issues, opening up scenarios in which the guarantee will facilitate access to credit and loan term compared to the world.

The EIF loan benefits from the support of InvestEU, the EU program that aims to mobilize at least €327 billion by 2027 to be allocated to European strategic priorities.

“In the real economy, small and medium-sized businesses need access to credit as a second problem, after obtaining customers – notes Alessandro Tappi, Chief Investment Officer of Fi. The guarantee facilitates access to credit thanks to the risk part of Fi facilitating the possibility of banks giving credit “

According to predetermined eligibility criteria, the bank independently disburses the loan and makes use of a guarantee. credit.”

“The EIF contributes part of the guarantee, and that makes the concession, and so the possibility of being able to expand lines of credit to such an extent that without that guarantee it could be limited – as Kuhn asserts -. So it becomes an effect like we said, it’s multiplier, it’s an expansion effect. So , in the face of the guarantee that Fei places in the hands of Bper Banca, it offers the possibility of accompanying the real economy of two or three sums.

Loans can really make a difference, especially in a complex phase like the current one.

“There are three very important issues that intersect in a particularly difficult economic situation – Fei’s chief investment officer continues to think – one is the economic situation, interest rates are rising, the uncertain economy, especially difficult geopolitical issues. Environmental. And the third is the issue of digitization. Bringing these three components together, it is clear that companies need access to significant medium-term credit. With this, we are trying to achieve this goal.”

A path, the path towards sustainable transactions, which sees Bper Banca playing a leading role:

“I recall – points out Cohn before concluding – that Bper Banca has a business plan that considers a large number of loans from an ESG perspective, with the aim of supporting migration towards a world with more important sustainability indicators than the current ones”.

“Evil zombie trailblazer. Troublemaker. Web enthusiast. Total music fan. Internet junkie. Reader. Tv guru.”

More Stories

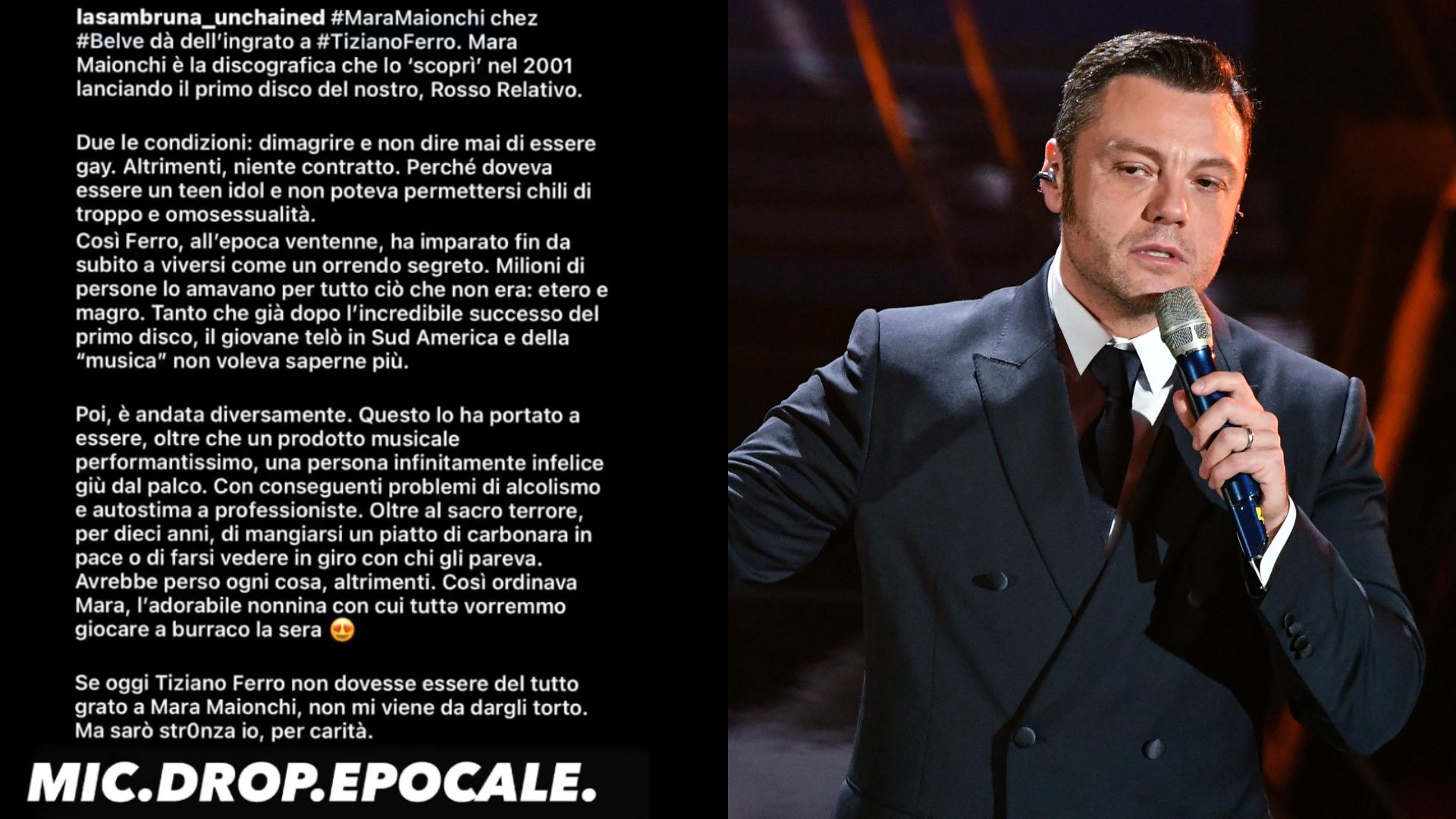

Tiziano Ferro The accusation against Mara Mioneschi: “She made him lose weight and pretend to be straight” The singer shares the message

May Day Party in Rome: Live from Circus Maximus

Singers, lineup, live TV and times