There are many questions we ask ourselves, when it comes to Rai license fees, here in this case who will pay and how

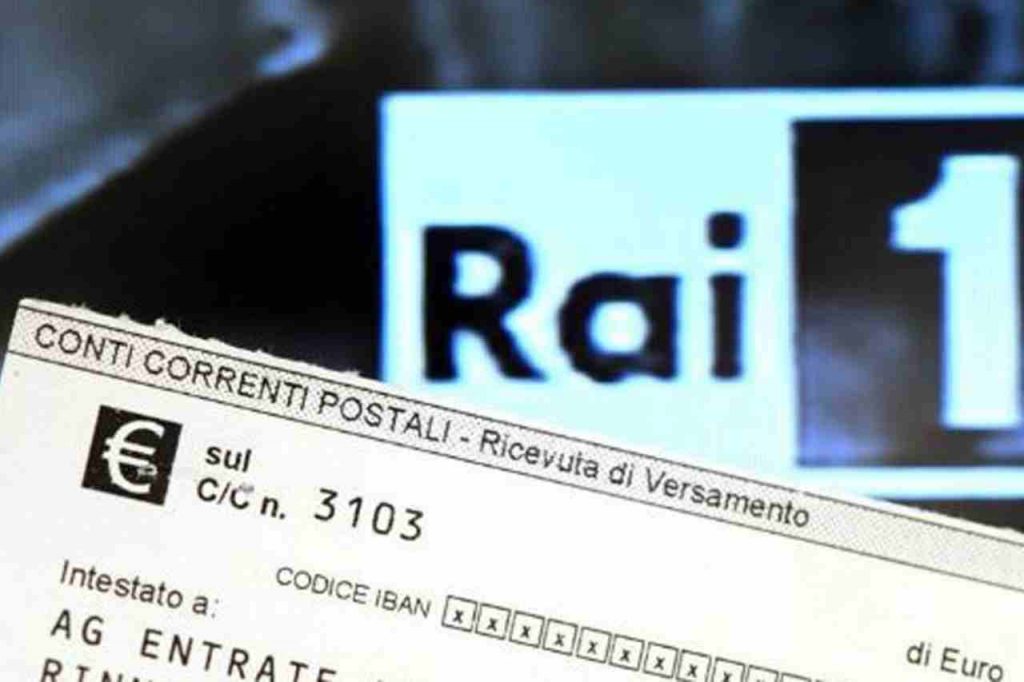

We now know that a file Rai license fee It’s a real tax. In fact, it is recognized as a tax on owning a TV. This means that even if the owner of the electricity user is someone else, whoever owns a TV will have to pay for it.

Indeed, even from this, doubt arose: if You pay the electricity bill but not the rai license fee, what do you risk? Because in reality the two should be considered completely separate. In fact, the fee for the company that supplies us with the power is not being paid to the same, they are just two different charges, they ended up on the same bill.

Rai fee, here is who will pay it if expenses are included

And then in any way, they go to distinguish between those who already find themselves covered in the monthly expenses private rent? Let’s take a step back, nearly six years, to better understand the tax function. Since 2016, the state has access to Rai license fee collection, listing as Direct deduction on the electricity bill. So to avoid very significant tax evasion, we went on to imagine that everyone who owns an electrical utility, also owns at least one television in the house.

In the case of Possession of electronic devices How it works? Far from this legitimate question, €90 per year ends up billing other users. If you have the right, the only thing you can do to escape it is submit a replacement permit and send it to the Revenue Agency for an exemption. Otherwise, everyone pays.

Also Read >>> Not Just Rai Fee: Another Tax That Might Soon End on the Bill

Yes but how? This is the dilemma. Apart or in the famous expenses included? In fact, the tenant owns a TV, so from the moment he settles in the house, he will still be the one using the previously purchased thing. He pays the tax, so there will be two cases to study. L ‘The tenant with electricity in his name, He pays the electric bill in the name of the tenant himself. L ‘The tenant with electricity is still in the name of the owner, You will pay via Form F24, as there is no registered user, the fee cannot be charged. Be careful not to make the mistake of assuming that the homeowner also pays us this separate tax, because you could become a tax evader.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

-U14831412660OWK-1440x752@IlSole24Ore-Web.jpg?r=1170x507)

More Stories

A fine of one thousand to five thousand euros for the owner who renovates the house with a violating company

Can artificial intelligence beat the markets? Governor May

Bills, do you pay more in Italy? Ranking of European countries