A 19-year-old Egyptian was arrested for possession He beat a guard from the Jewish army with a stick On the...

A YouTube millionaire, determined to prove that he can build a million-dollar fortune from scratch in one year, was forced...

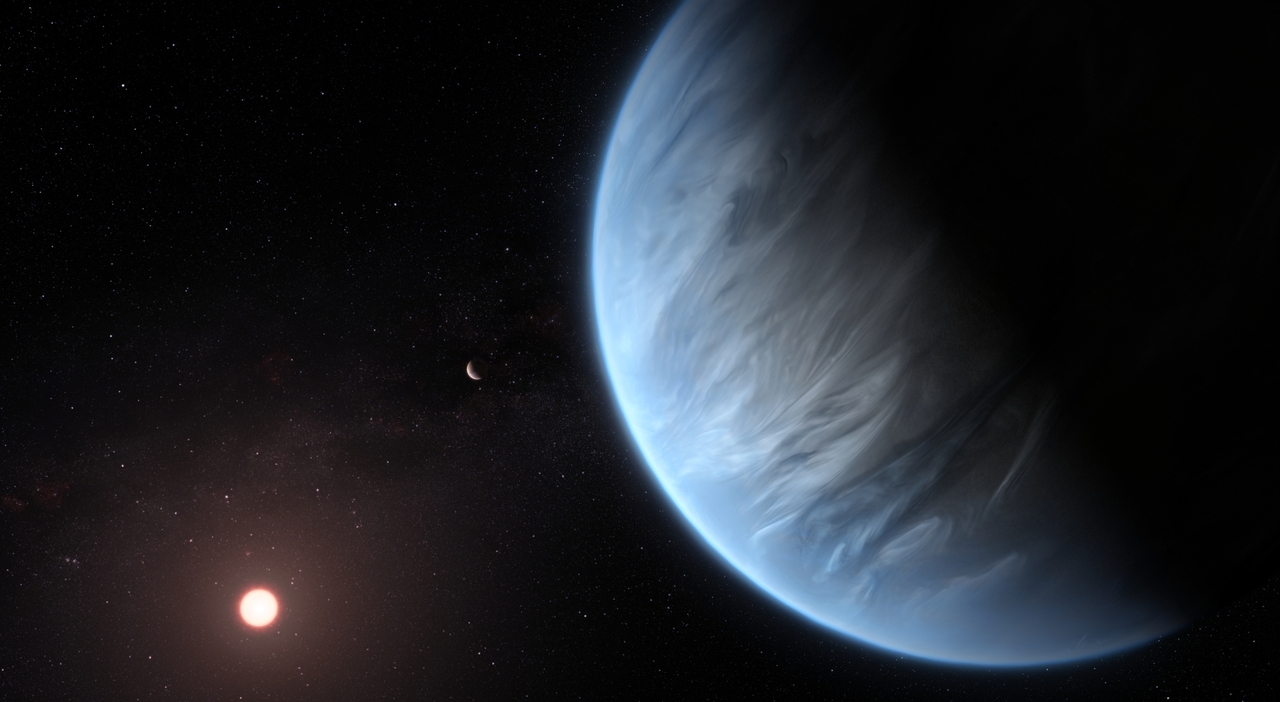

An exciting discovery may be closer than ever, and capable of completely changing our view of the universe: Proving the...

Here is the expected lineup for the Bologna-Udinese match: ▪ Bologna - Udinese - Sunday, 3pm, Stadio Dallara▪ Referee Saki▪...

What is for'icon With the Double arrow Submit your WhatsAppbut who can everyone still see? Soon this symbol will be...

Air conditioning, this is the trick to saving money - sourcedepositphotos.com - autoruote4x4.comSummer is coming: discover the trick to optimize...

Time to study1 minute, 58 seconds Italian Weather NewsThe situation is 8 am. The Arctic intrusion that has reached Italy...

In a country where a bank - Intesa - gives parliamentarians an incredible interest rate of 5.6250 on well-kept liquidity...

Benedetta Rossi conquered her kitchen Source @Instagram – ifood.itBenedetta Rossi was killed by him, and no one expected a food...

April 26, 2024, at 06:503 minutes read Palermo - A touch of the magic wand will be enough, Sign in...