Transition 4.0, MISE-approved models for communicating data on investments within facilities are online. The administrative reference decrees are those approved on October 6, 2021. For the facilities stipulated in the 2020 Budget Law, the form must be submitted via the approved email by the next December 31 deadline.

Move 4.0, I am connected to the internet MISE MODELS NS data connection From the investments of the franchised companies.

With such models approved with three Administrative decrees issued on October 6, 2021Companies can communicate information about investments made to:

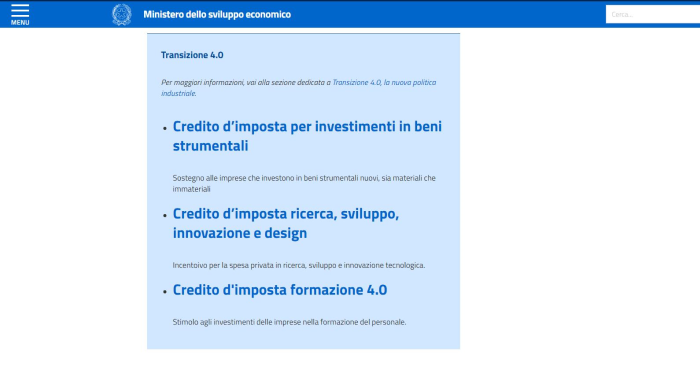

- tax credit for investments in capital goods;

- credit tax Research and development, innovation and design;

- credit tax 4.0 . training.

Contact must be sent by the end of the year or no later The deadline is December 31, 2021.

The form must be digitally signed by the legal representative of the company and must be submitted in electronic format via PEC at the address of the establishment.

Communication is not a necessary requirement to avail the facility. Purpose, in fact, is only purpose Evaluate the progress, dissemination and effectiveness of support measures.

The Failure to submit does not preclude the use of the procedure, through the control of financial management.

Transition 4.0, MISE models for online investment data communication

A piece has been added to the scales located within Transition 4.0.

I’m online Forms prepared by MISE, which companies must use to transmit the data of the investments covered by the franchise.

The Expiration set to contact is December 31, 2021However, failure to redirect does not automatically exclude subjects from using the facilitation procedures.

Forms approved with i Three administrative decisions dated October 6, 2021, which refers to the three different facilities provided.

The first, the tax credit for investments in capital goods, aims to support and stimulate companies that invest in new capital goods, tangible and intangible, functional for the technological and digital transformation of production processes.

The second, the Research, Development, Innovation and Design Tax Credit, aims to stimulate private spending on research, development and technological innovation to support corporate competitiveness and enhance digital transformation processes and in the context of a circular economy and environmental sustainability.

The third, the 4.0 Training Tax Credit, aims to support companies in the process of technological and digital transformation, and to create or enhance skills in enabling technologies needed to achieve the 4.0 model.

Transition 4.0, deadlines for calling and sending via certified email

The data connection for investments that fall under the Transition 4.0 attachment must be sent after The deadline for each facility.

The Deadline December 31, 2021 In fact, it concerns only establishments that are subject to the law of December 27, 2019, n. 160, or the 2020 budget law.

Investments related to Law No. 178, or the 2021 Budget Law, the deadline for sending the communication is Submit tax return for each tax period in which the investments were made.

However, it must be used same model approved with me Three administrative decisions dated October 6, 2021.

- MISE – Data Communication Model for Tax Credit for Investments in Functional Capital Goods for the Technological and Digital Transformation of Companies

- Annex 1 of the Administrative Decree issued on October 6, 2021.

On the other hand, there are many PEC . reference addressesto whom the form should be sent.

to any concern Tax credit for investments in capital goods, as also shown in Administrative Decree issued on 6 October last, the connection must be sent to the PEC address [email protected].

about Tax credit for research and development, technology innovation, design and aesthetic thinkingHowever, reference must be made to the relative Administrative decree from the same date. The reference PEC address in this case is [email protected].

Finally, for 4.0 . Training Tax Credit, the reference PEC address is [email protected], as shown shortly Administrative decree.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

IRS Shock: Goodbye Tax Bills, They'll Take Your Money Straight From Your Account

Perfect BBQ With LIDL Offers, your May 1st BBQ will be unforgettable: professional accessories at low cost

Income 2023, the highest in Marche in Nomana. Ascoli raises the rear – Current news – CentroPagina