There is definitely bad news for Italian current accounts and there is talk of a double sting.

Let’s see why we talk about forced double withdrawal and how this terrible double pullout works. It must already be said that Italian current accounts are increasingly expensive to manage Because of the high costs charged by Italian banks.

Unfortunately, this is not the forced double withdrawal which many refer to.

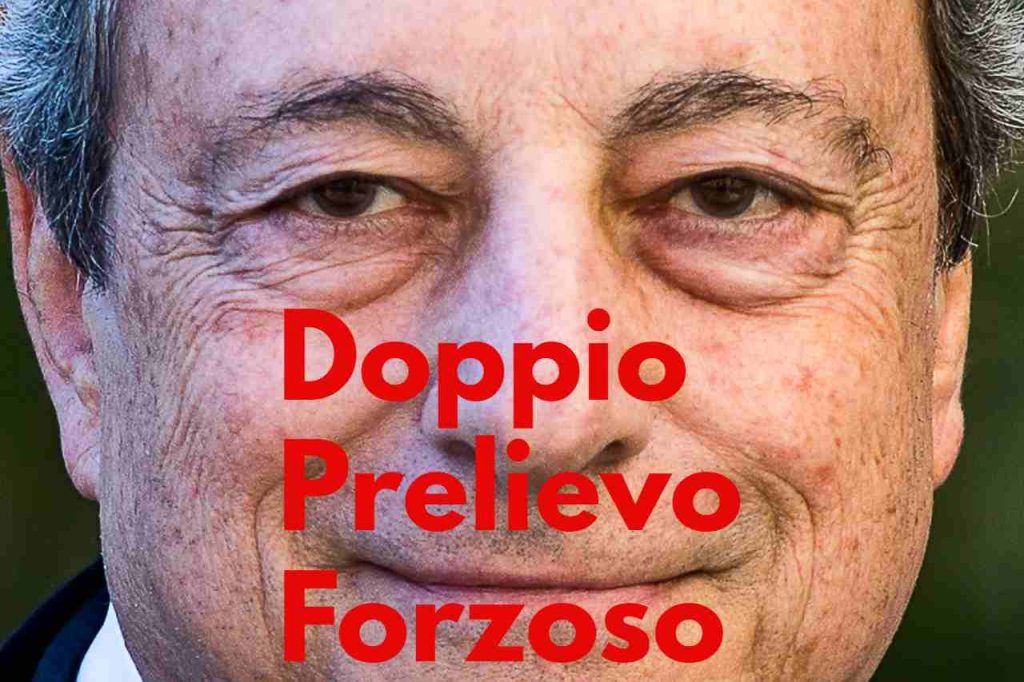

Double forced withdrawal

Italian banks are increasingly expensive, so the costs are always increasing for account holders, but now this terrible forced withdrawal also appears.

Forced withdrawals on the account are two, and while one is very powerful, the other is lighter, but it’s a real bite. One cannot escape from it. In fact, the first forced withdrawal is precisely the withdrawal of inflation. Inflation in Italy has reached 8%, which means a rise For every €10,000 held in the bank account over the past 12 months, up to €800 was burned in real purchasing power. This is clearly a huge sting because losing 8% of all your savings in just 12 months really is a terrible blow to Italian families.

How to defend yourself from the first sting

To defend against inflation, you can invest In postal savings bonds, treasury bonds, or real estate. However, these are investments that allow inflation to be offset only to a certain extent because they obviously do not offer a return of 8%. There is also a strong argument that banks do not offer any bonus for free money in the account. With an 8% violation, the banks will have to recoup the free money in the account but in the meantime they don’t. But another forced withdrawal on the current account is already active and it is tax fee.

How to defend yourself from the second sting

In fact, on all checking accounts with a balance of more than 5,000 euros Seal duty is triggered. The stamp duty is just under 40€ per year for private clients and 100€ per year for businesses. Since this is a real tax, it cannot be avoided by changing banks or going to cheaper online banks. In fact, stamp duty is also applied to online accounts. The way to keep the stamp duty away is precisely to keep the stock around €5,000 Maybe invest the rest. It is clear, however, that every investment has risks and especially in these times we should be especially careful.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

IRS Shock: Goodbye Tax Bills, They'll Take Your Money Straight From Your Account

Perfect BBQ With LIDL Offers, your May 1st BBQ will be unforgettable: professional accessories at low cost

Income 2023, the highest in Marche in Nomana. Ascoli raises the rear – Current news – CentroPagina