Directing savings towards our dreams and projects is the consultant’s challenge in the very near future. Form midway between a personal trainer, family doctor, and dietitian. This was discussed in an Assoreti webinar

What is savings? Is it what remains in our pockets after we spend? “No,” replies, Fabrizio Forniza, speaker at the New Generation Plan event, organized by Assoreti in collaboration with Eumetra and the Sole24Ore Group. “Savings are not a residual variable. We need to move from a precautionary view to a planning one,” confirms partner Eumetra. As far as the cash benefits are concerned, the Italian family “has very good chromosomes,” but their traditional caution risks making them “very conservative.” And this is where financial advice should come into play, as if it were a sports coach, to raise families’ odds from the short term to the long term.

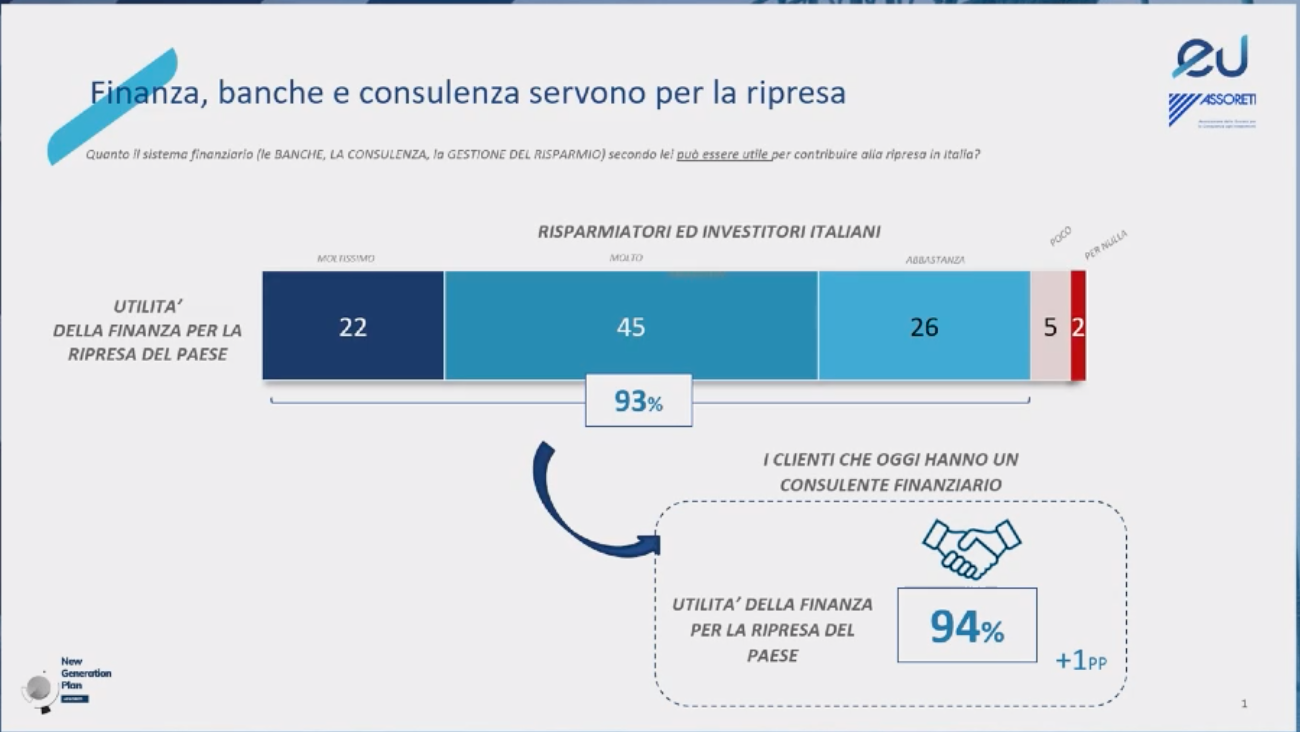

It must be said that families are “very willing to put their savings into action to contribute to the reconstruction of Italy. Think of the great success of issues such as: PTB FuturaFrom the mapping of Assoreti and Eumetra, the restoration of confidence in the banking institution is shown. But above all there is an awareness of the need for savings planning and financial education:

The importance of keeping planning

«The construction of the project affects all families, not just the wealthy», Fornezza continues. And “the role of the financial advisor becomes essential. She must support the family in the path of development and progression: There are often opportunities that families do not know about. It’s not just about investing, but also getting help in certain moments of vulnerability. You should have a “financial coach” such as a family doctor. There is no need for senior specialists, but for people who are able to achieve “financial health.” A major change in the language is already underway. “We are moving from talking to the wallet to talking to people.” Of course, “if we compare the consultant with a dietitian, we must understand that he gives us the diet, but then it is up to us to follow it,” Fornisa concludes.

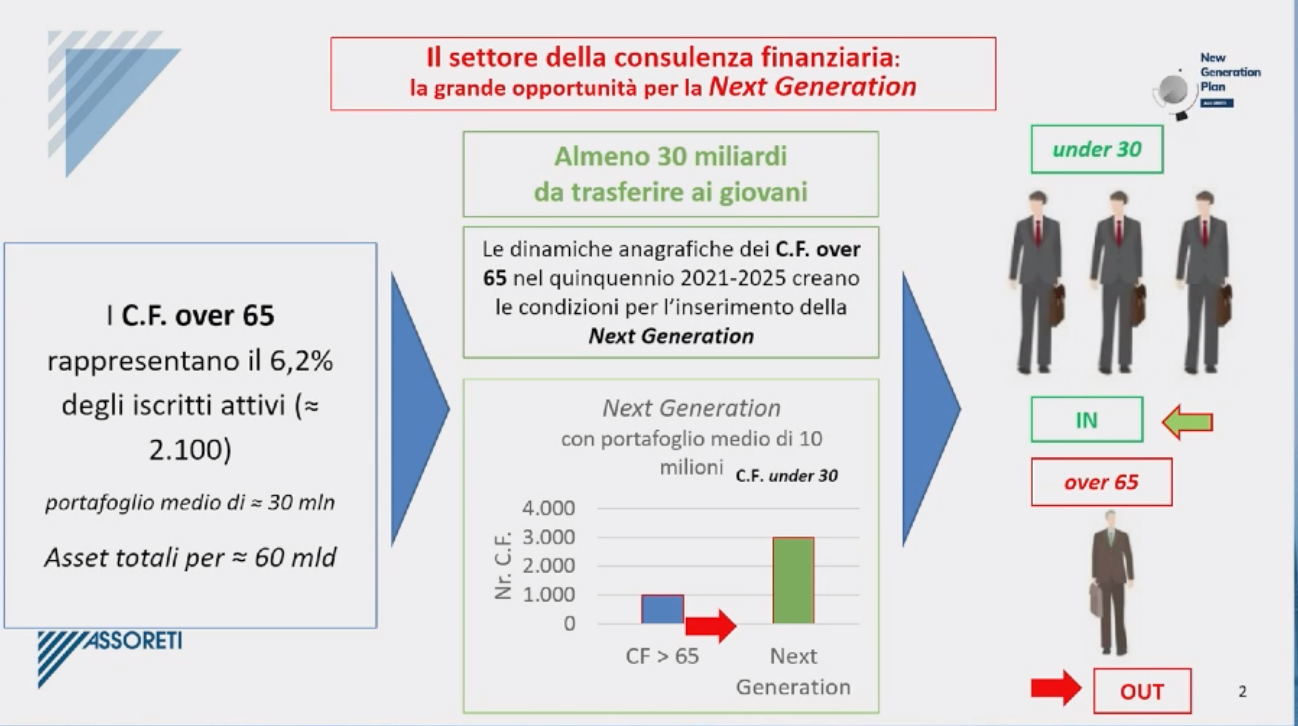

Paolo Molicini, Head of Assoreti, intervenes, “Today the quality of the consultations has undoubtedly increased.” “If in the 1980s the advisor recommended only a good financial product to the client, today he supports savings planning. Do I want to study and start a family? These are questions that a professional cannot ignore. We are not in finance, we are in the realm of trust. We no longer start from consumption and savings, but from people’s projects. ” The profession of financial advisor is a rapidly growing profession, reveals the head of Assoreti: “In terms of finance, each professional has doubled their portfolio under management (from 11 to roughly 22 million). We, as banks, need young people more than ever before: we are preparing to face the largest corridor of wealth ever. ”

The tendency towards youth felt by Assoreti is very strong. “A young counselor has to learn a balance that is not always commensurate with his young age, but in our world it is learned quickly,” Molessini continues. The topic of financial education was very well felt at the governmental level. Claudio Dorrigon, undersecretary for the Economy and Finance Ministry, reveals that an employment adjustment and training of young financial advisers are being studied. The cost is estimated at about 6 million euros, and can be “included in the transfer of the decree of support 1 or support 2” for about 6000 young people with resources coming from European funds.

A new generation of savings planning consultants

But the bulk of Italian savings (our weak public debt) can only make a difference when we realize our strength as investors. “Just as there are good and bad debts [qui la differenza spiegata da Mario Draghi]There is a difference between beneficial and harmful investment. The first positively affects sustainability, progress and the environment; Second no. An investor can change the world by investing in the right sectors. ”

Paolo Molicini also notes that the financial part of Italy’s wealth is “extremely cautious”. In particular, there is a “surplus, if not negative, of unproductive real estate assets due to taxes, administration costs, lack of return, and the impossibility of selling.” The new financial advisors will have to face this problem, awaken the “dormant issues” and create a good GDP. ” The head of Assoreti concludes by saying, “The profession of financial advisor is not barren, it is not a“ financial trade. ”And how could it be?

Teresa Scaral

Editor in Chief

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”