Although we crossed certain levels and the trend in previous rounds became positive, yesterday we wrote in this section: “The rally of the last few days has not completely convinced us, so we will wait for more confirmations or denials of what will happen tomorrow.. This means that the trend should be followed, but without euphoria or fear but with significant reeling, also bearing in mind that this bullish signal could be false and leave room for new lowers immediately.

Today, Thursday’s impact has triggered a rebound. What will happen from tomorrow onwards? We will now see the levels that will lead the stock markets to new highs or new lows but let’s go step by step.

We read the following prices at 4:47 pm on August 26:

future dax

15,793

The future of Eurostoxx

4.164

Ftsy Mibe future

25,880

S&P 500 . Index

Our annual forecast has entered a bearish phase but prices are still on the upside

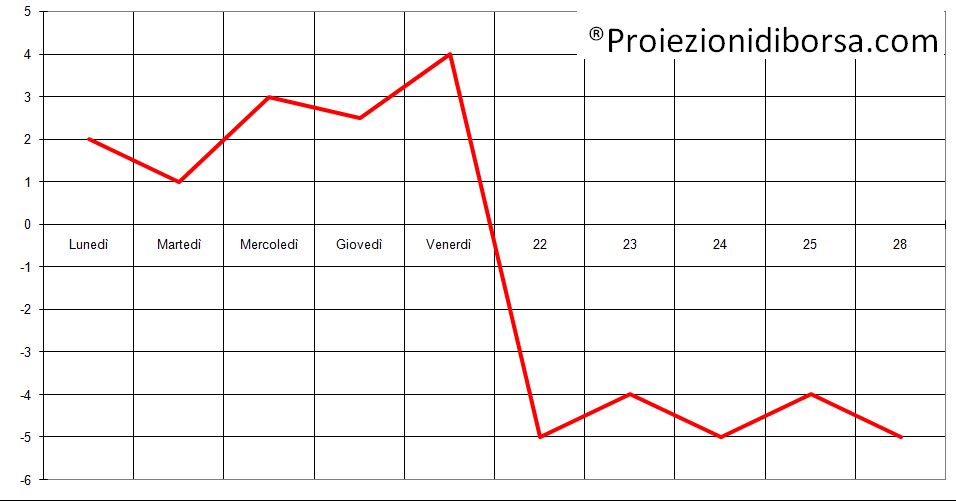

In red our annual forecasts for the weekly Global Equity Index for 2021.

In blue the US markets chart until August 20.

These are important moments for the trend until the next setup on October 5th.

Forecast for the week of August 23

The weekly decline was expected between Monday and Tuesday and then left room to rise until Friday. As of today, this scenario is starting to creak and may drop further tomorrow.

Levels that will lead stock markets to new highs or new lows

future dax

The uptrend is in progress. Short bearish reversal with daily close on Aug 27 below 15790.

The future of Eurostoxx

The uptrend is in progress. Short bearish reversal with daily close on August 27 below 4.152.

Future Ftse Mib

The uptrend is in progress. Short bearish reversal with daily close on August 27 below 25880.

S&P 500 . Index

The uptrend is in progress. Short bearish reversal with daily close on Aug 27 below 4.450.

What trades should be held for Friday?

Buying on the analyzed indicators, but the chances that this is a false signal and that a new bearish phase may begin, are even higher. Tomorrow, affirmations or denials.

As usual, we’ll go step by step.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”