The more weeks passed, the more diplomatic and economic moves of the two opposing blocs could bring about significant (at least potentially) changes in the international currency system.

The first shock to the now precarious equilibrium was the Western bloc that imposed a freeze on the foreign exchange reserves of the Central Bank of Russia held in Western countries. This is a move that in some ways seems suicidal because it affects the confidence of all the countries in the world that have dollar reserves and which – for whatever reason – can be blocked at any time with a single click by the Western bloc. In fact, Putin himself defined the Western move as “the backwardness of the dollar and the euro against Russia.”

A real earthquake led to immediate counter-moves by Moscow.

First of all, it negotiated trade with the countries of the former Soviet Union in their national currencies in predetermined proportions. Negotiations themselves are underway with India, China, Iran and Turkey (a country that is officially part of NATO).

It should be noted that all these countries (except China) also operate their own interconnection in the Russian international payment system Mir as an alternative to the Western SWIFT system (from which Russia is actually separated). In return, Russia is negotiating the interconnection of its interbank payment system with the Chinese system called CIPS.

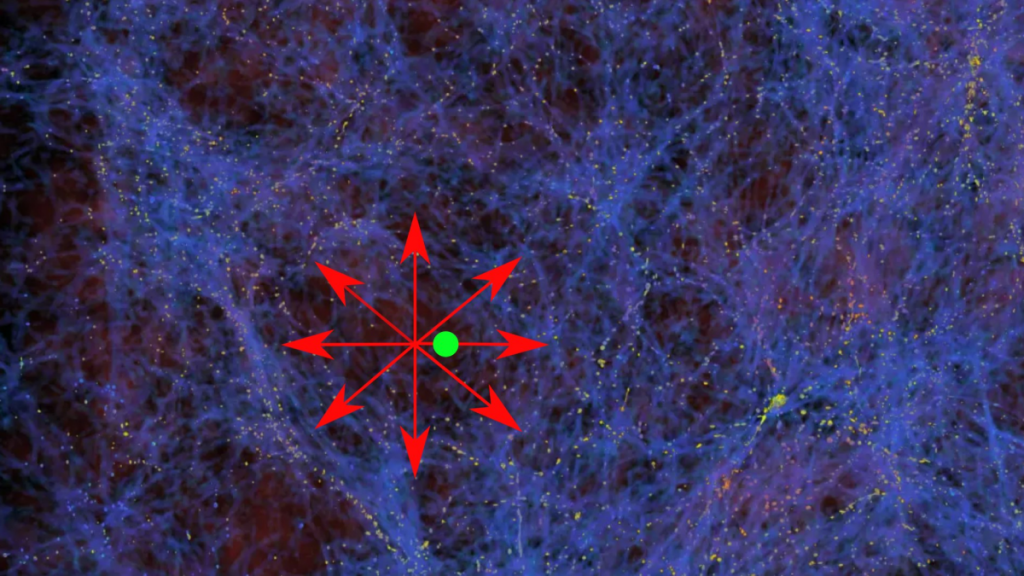

Apparently squaring the circle, an Asian bloc has given birth to an alternative to the Western bloc and has its own reference currency, its own interbank payment system (or two interconnected systems, the Russian Mir and the Chinese CIPS). From the point of view of the real economy, the integration seems perfect here too: Russian energy and military power add to the Chinese industrial, technological and demographic strength as well as a series of dependent states. Are we heading towards a rapid de-dollarization of Asia? Kind of back to the block world we knew in the last century?

It seems so. But the devil, as usual, extends his hand in it. What is dollar dominance that we all know? To be read in the books, it is based on the agreement Nixon made with the Saudis that saw the birth of the petrodollar: the Saudis get paid for oil in dollars “forcing” all the countries of the world to hold dollar reserves if they want to. Buying oil. Other authors argue that the dollar’s dominance rests primarily on 6,000 US-made nuclear warheads and on a military device so powerful that no one else can access it. These are two facts, both true but unable to explain all aspects of the problem. There is a third truth, the truest of all, that explains everything and for it is inconvenient for everyone to be silenced or by some not even thinking of it.

The strength of the dollar is due to the fact that the United States acts as a “buyer of last resort” for the whole world, thus absorbing surplus production in the rest of the world and at the same time flooding the world with those dollars necessary to “soften” the international trade of other countries. But the unspeakable secret of this mechanism is clearly another (and a Marxist certainly cannot escape from it), for by importing all the surplus goods of the world the United States also imports pain and suffering. Unemployment is important. It is clear that if the United States imports goods (to support the mechanism) it produces less at home, condemning large sections of its population to suffer unemployment, underemployment and exploitation. Yes, the dominance of the dollar is based mainly on the suffering of the poor working class. This is the unspeakable secret.

Now, back to us, which country of the nascent Asian monetary bloc is able to bear the colossal share of suffering that burdens the American poor? China? Hard to believe. India? even less. Russia, too small to experience economically.

In short, it is hard to believe that in the short to medium term another monetary system completely separate from the dollar may arise. It may work, perhaps in the emergency phase of the ongoing conflict, but waiting for a major agreement after the end of the nightmare of the Ukrainian crisis.

In the great currency game, the euro, our currency, deserves a special mention. It is a currency without a state and without a constitution. It is a currency that exists in a selfish, contentious and thus divided economic zone. It is a currency without military support and surrounded by large areas of crisis (in Eastern Europe and the southern shore of the Mediterranean). It is a technically backward monetary area due to the crazy 30 years of deflationary policy including through fierce cuts in research and education. Finally, it is an energy-insecure monetary area.

Here, instead of asking about a hypothetical cancellation of the dollar that should be planned, we should ask ourselves about the true ability of the euro to overcome this massive crisis.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

Perfect BBQ With LIDL Offers, your May 1st BBQ will be unforgettable: professional accessories at low cost

Income 2023, the highest in Marche in Nomana. Ascoli raises the rear – Current news – CentroPagina

Jinja has an average income of 22,106, Fabriano: here is the data