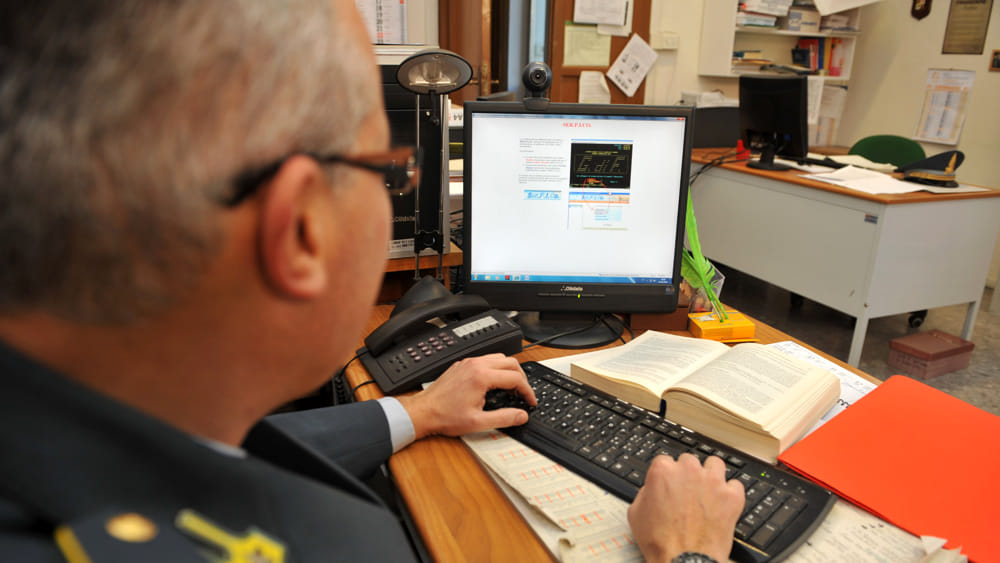

Tax evaders warned: There is now a new digital tool that will help the Revenue Agency identify anomalies and suspicious movements in checking accounts. Its name is VeRa, which stands for Verify Financial Reports, and it is the new algorithm approved by Economy Minister Daniel Franco and privacy guarantor that in the coming months will look for anomalies between income, checking accounts, movements and purchases. Digital. VeRa will also have the task of investigating digital invoices for VAT numbers and electronic payments, with the aim of collecting more than 14 billion euros of fraudulent taxes that have been discovered and thus reducing the gap between taxes owed and collected.

How does VeRa, the anti-evasion algorithm work

According to the first information reported Republic, the Sogei algorithm will be able to process millions of data simultaneously, by crossing account data with those of real estate, invoices issued and electronic payments made. At first, the data will be anonymized and will later be linked to the taxpayer: at that moment, the human assessment will begin. To automatically encourage citizens to comply, the Revenue Agency will send a letter to the taxpayer requesting that the bill be paid before the official assessment begins. A kind of warning that allows the taxpayer to explain any problems.

“We start from the results of recording financial relations, or all current accounts – explained Alessandro Santoro, the ministry’s advisor on tax evasion – if the algorithm identifies significant deviations between the balance at the beginning of the year and that at the end of the year, apparently not justified by anything, such as inheritance, donations property, and gains, then the management takes the first step. This rule has been in place for more than two years, but it has not been implemented.” According to preliminary estimates, the government should send about 2.5 million letters to as many taxpayers as possible, as well as the revenue agency’s use of drones, which are often used to identify “phantom” property.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

Perfect BBQ With LIDL Offers, your May 1st BBQ will be unforgettable: professional accessories at low cost

Income 2023, the highest in Marche in Nomana. Ascoli raises the rear – Current news – CentroPagina

Jinja has an average income of 22,106, Fabriano: here is the data