The Guardia di Finanza is ready to go with comprehensive checks county Foreign currency in the coming weeks: in the eyes of the tax authorities, the names and tax codes of taxpayers who have accounts abroad or with whom financial and professional operators have concluded transactions abroad.

Here is the risk

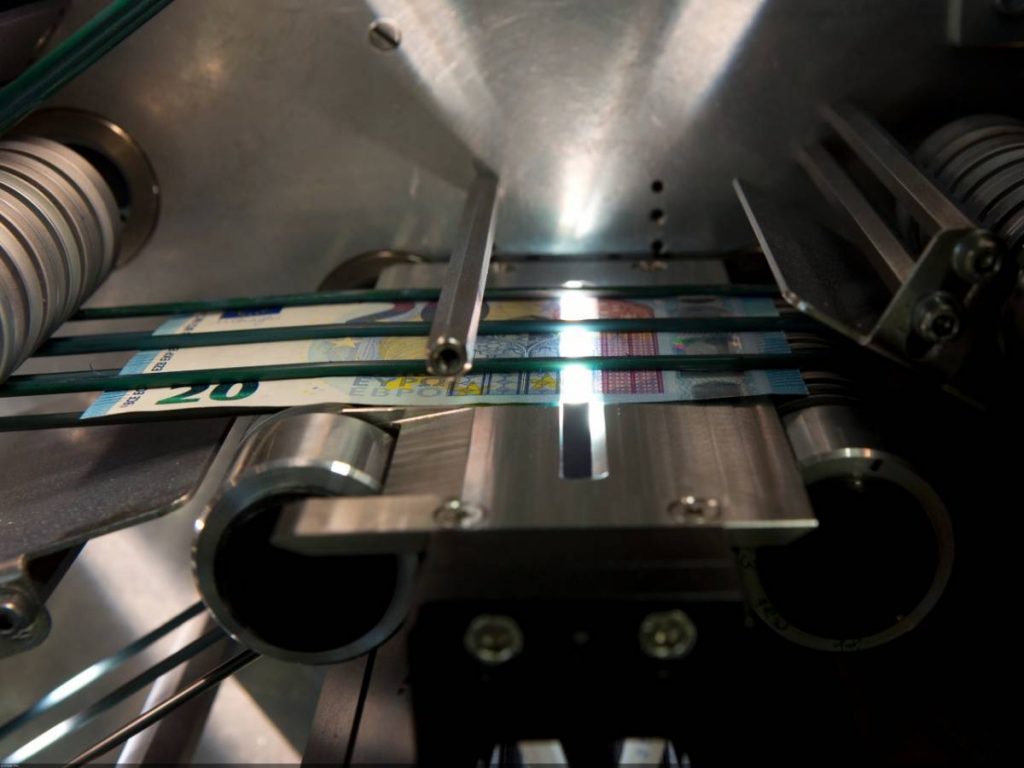

The questionnaires sent are aimed at obtaining as much information as possible about the processes, trying to identify and avoid them وتجنب Forgery. will be the purposeStrengthening tools to combat the illicit transfer and acquisition of economic and financial assets abroad, allowing to obtain information of important operational importance related to cross-border transactions in which tax evasion and other associated crimes may be hidden”, reads Circular No. 018399 of July 2, 2021. All topics related to foreign countries will be of interest to Fiamme Gialle: brokers, banks, investment companies, cryptocurrency companies, electronic money institutions, trust companies, loan companies, online game companies, accountants, lawyers and notaries.

Operations under control

The operations at risk will be all operations that exceed the threshold of 15 thousand euros, an amount after which financial control is activated. As reported, exceeding this limit triggers validations regardless of whether it is a single or split process. When the GdF questionnaires are sent out, there will be 15-30 days from time To provide appropriate answers and avoid falling into the eye of cheating, evasion and evasion. In the event of non-response, penalties are envisaged, the amount of which can range from a minimum of 2,000 euros to a maximum of 21 thousand euros. However, in the case of reservation, fines ranging from 250 euros to two thousand euros are envisaged.

Controls of “flying” in Dubai

As we dealt recently (read here), Italy requested Germany, through the Revenue Agency, data of Italian citizens contained in files purchased by Berlin from an anonymous source relating to persons with origins in the UAE, in particular in Dubai, to search for evaders. From taxes: In this way, the Italian taxman intends to put a speaker in the steering wheel for those who own legacy In the Emirates, away from prying eyes. To activate the procedure in the new “Dubai List”, it will be, as mentioned, the agency that can also receive assistance from the Guardia di Finanza and with which it has the possibility of exchanging tax information. This indiscretion came on the day that GdF discovered 3,500 total tax evaders with forfeiture proposals for 4.4 billion euros for 2020. According to sources, Germany obtained tax data from an endless “list”. Origins in the UAE including, of course, also thousands of German citizens. This data will be used in Berlin to evaluate possible hypotheses for tax evasion. “We all use Means Learn about tax violationssaid Social Democrat Finance Minister Olaf Scholz, who is running for chancellorship. “On my initiative, the Federal Tax Office obtained a CD containing financially relevant data from the Emirate of DubaiSchulz himself added to the German newspaper Der Spiegel, stressing how tax evaders are compared to criminals.

Finally, those who have not adhered to “voluntary disclosure”, that is, “pardoning the capital issued abroad, comes the reckoning: those who have not complied with the tax authorities, even if they do not necessarily end up in financial paradise, will be “attentive”.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

Alfa Romeo Junior: designers speak

IMF: “In 2026 Italian growth will collapse to +0.2% due to the cessation of the supergrant and less stimulus from the Pnrr program”

Armani opens up about the turning point: “I do not rule out a merger or initial offering.”