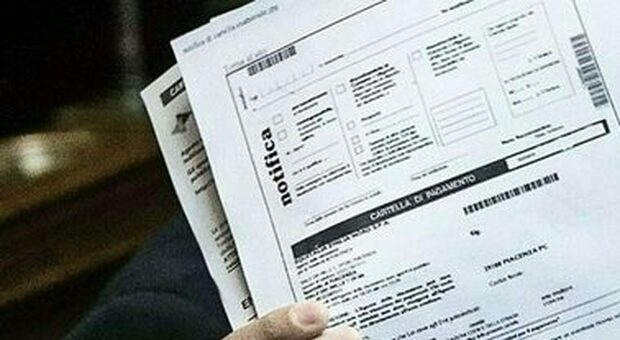

Countdown. And this time nothing seems to be able to stop him in the extreme as it has so far. In exactly one week, 20 million will start arriving in the virtual mailboxes and inboxes of Italians tax bills His notification was suspended in March 2020, at the start of the pandemic. This time, as mentioned, except for unexpected surprises, there will be no new downtime.

Rome, fines and tax bills: 30 thousand at risk of cancellation

Tax records, their stages

There are no decrees on the agenda as a new postponement of the deadlines must be initiated. The Minister of Economy, Daniel Franco, has set the next meeting with undersecretaries and deputy ministers to evaluate the budget law only for next Tuesday, the first of September, which is exactly the day when the collection machine starts again. At the Treasury, they believe a new transformation is not possible. Missing the December 31 deadline will entail the need to find a few billion euros to cover the new freeze. But that does not mean that the issue of tax bills has been left on the government’s agenda. The intention is to act on two fronts. The first relates to the Revenue Agency – Collection. In September, it will not send all the files that have accumulated in its 20 million drawers. A maximum of one and a half million will leave. The reason is that the agency’s operational capacity is basically this. And this, by the way, means that it will take at least a year and a half to deliver all 20 million files. But there is actually another reason as well. The back files to turn in are documents largely shaped during the pandemic. Actions, in short, that will affect to some extent the same companies or citizens that the government has compensated and helped in recent months by allocating billions. A way out has to be found, and it’s not a bad freezing of folders. What appears to be at hand is a fourth scrapping.

Taxes are null and void if the tax authorities do not notify the taxpayer first

The strategy

The justifications will be different. The first, as mentioned, is that the notification of 20 million bonds with the resumption of foreclosures, could undermine the climate of confidence in the country that is fueling the recovery. But there is also a second, and perhaps even stronger, reason to equip a new “financial peace” process. In July of this year, Economy Minister Franco deposited a proposal to reform tax collection in Parliament. Which contains many new features including simplified premium folders, as well as premium review. In addition to emptying the so-called “repository” of old volumes, uncollected ones from 2000 to date which alone are worth nearly a thousand billion euros. So if the first three were canceled so far in “normal” times and only with the promise of tax reform, the reason now is that times are not “normal” and reform is really on us. So quad scrap can be included in the budget maneuver. All conditions have not yet been decided. One hypothesis is that acts are exempted not only from fines and interest, but also from collection fees, given also that in reform the latter should disappear. Meanwhile, at the end of July, the Agency for Revenue – Collection already provided evidence for the resumption of payments. Among other things, remember that payments for suspension items can be paid in installments, but an application must be submitted before the end of September. In addition to the volumes, scrap payments have already been resumed, with the first payment due on August 2. Installment expired May 31, 2020 (scrapping-ter) Payment must be made by August 31 Installment due July 31, 2020 (scrapping-ter and Balance and excerpt) must be paid by September 30, 2020 By October 31, Installment expired November 30, 2020 (scrapping-ter). Then, on November 30, the February, March, May and July 2021 installment deadline expires.

The taxes here are the fake poor: 3 million evaded from 264 billion. The tax authorities are considering an amnesty to recover the money

© Reproduction reserved

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

Salary bonus, check the amount carefully in May: these days the wage doubles

Super Bonus, Giancarlo Giorgetti: Appropriations of $160.5 billion, 7.4% deficit does not affect the deficit

TFR or TFS paid late: ask INPS for interest