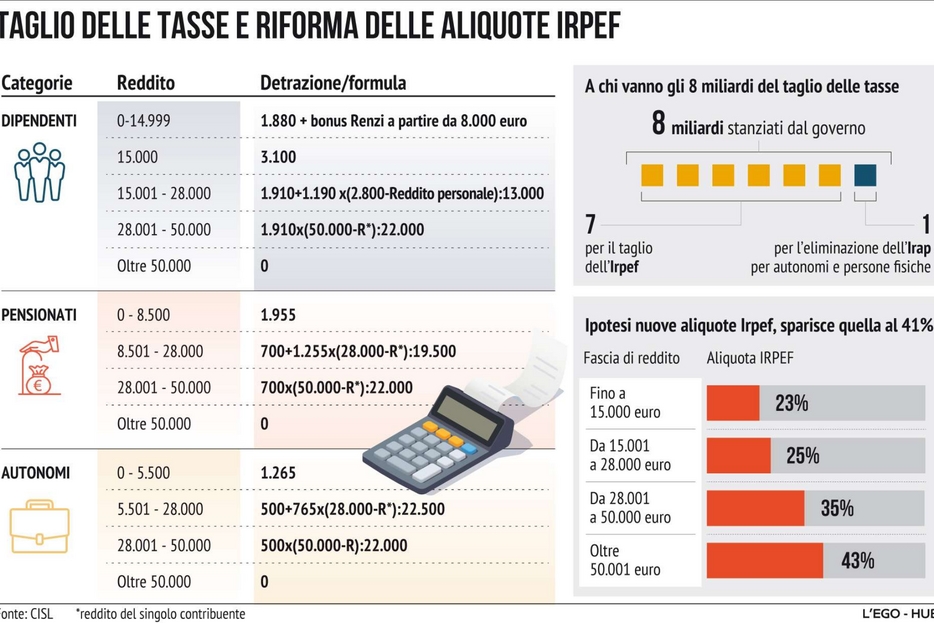

The tables in the Ministry of Economy are being refined before the distribution of the $ 8 billion allocated for tax cuts in 2022 is amended. 20 euros per month.

Instead, the new 4-rate system is confirmed: 23% up to 15 thousand euros, 25% from 15,001 to 28 thousand, 33% from 28,001 to 50 thousand, 43% above 50 thousand euros. A redesign that would result in a drastic reduction in the personal income tax for the average income, particularly the total of about 50,000, pulling the tail of the benefits, at about 270 euros a year, even for the highest income (an effect that cannot be managed by the government. Suppressing the number of center-right parties in the majority and IV).

To fully understand the picture, the new system of waste is missing, which was reached in the last minutes before the CDM on Friday. With this lever we tried to respond to the political accusation of not interfering with the middle-low and low-income, with a new base deduction set at 3,100 euros.

In the Budget Act, people in need of assistance have the right to home care and integrated social and health services

CISL federal secretary Giulio Romani, head of the tax department, explained that the deduction was in the range of, 14,999, as the Renzi-Conte2 bonus from ,000 8,000 would still operate at 100 per month. Income is not regenerated but it continues to be perceived as “extra”, which fully offsets the personal income tax of approximately ,500 12,500.

The choice of the government is to start getting back the Renzi bonus, but to do so in the income range of more than 15 thousand euros, the “general spread” will lead to the loss of something between the old and the old. The new regime. However, the summary of the tax intervention will not change: the biggest benefits of the new Irpef will be 40 to 55 thousand euros, with an income of around 700 euros per year. Central prices of Irpef.

Meanwhile, with much less shouting from the new Irpef regime, the intervention to impose fines on associations and voluntary work was sent to the Senate as part of a tax mandate linked to intrigue. Third-party spokeswoman Vanessa Fallucci warned: “From January 1, social realities need to be subject to VAT, even if they do not involve business activities.”

By 2022, 100 million has been allocated, at least three times as much to go from promises to facts. Waiting for the Framework Act and Pnrr

This arrangement provides for a transition from the VAT exemption rule to the services provided and the assets transferred by the companies to their shareholders only. “It seems like a small variation, economically neutral, but instead includes the costs of maintaining VAT accounts, fees and additional bureaucratic requirements, while the third sector faces the subtle step of implementing a single record. The introduction of this further implementation is incorrectly incorporated into the law in force today and Creating distraction and distrust in companies, especially small ones.

“If the reform announcement of the Third Amendment is welcomed with satisfaction for the expected simplification, such measures will be a great disappointment – continues to falter – we fought exactly a year ago because the same rule was added in the formulation of the budget law and then fortunately removed. Today, a year later, we are back to the starting point. We are.

The demand is to get the law out in the immediate passage of the room tax order. “The third sector must be supported and not harmed,” Ballucci said, adding that a few days later, another position of the third sector in the tender to upgrade the assets seized from the mafia was given only to local authorities.

“Gamer. Professional beer expert. Food specialist. Hardcore zombie geek. Web ninja. Troublemaker.”

More Stories

Blinken: 'US and China are managing their relationship responsibly' – Breaking News

The Premiership is right to compel the reporter. Reform will soon be in the House

Medicine: Free registration for first semester, at the end of limited numbers. White Coat Protest – News