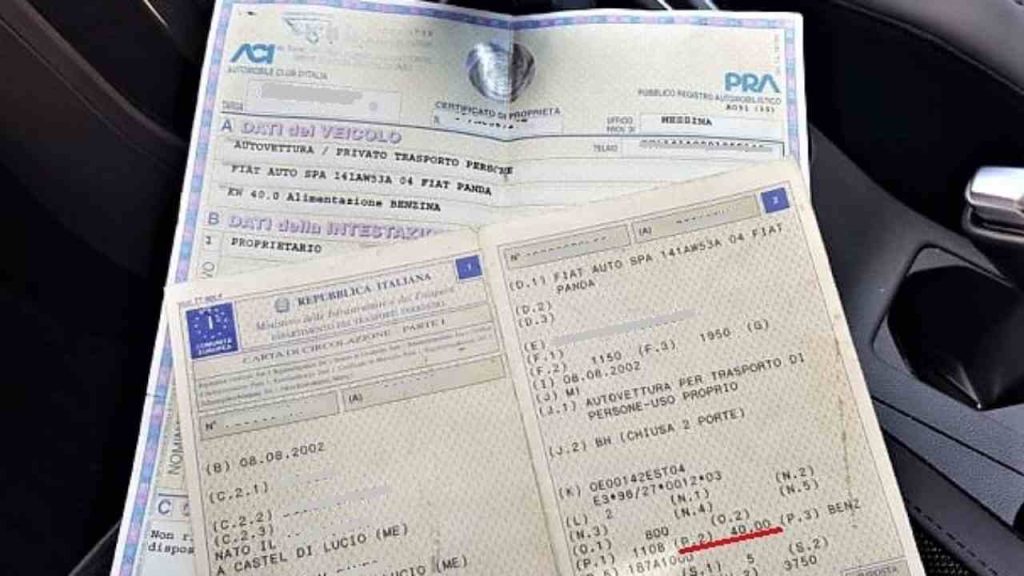

When buying a used car, you should be careful to check the car tax expiration date, if you do not want to pay for others.

Definitely the first aspects to consider when buying aused car that it Circumstances Vehicle technologies and that everything is consistent with what was announced in the offer, in the event that the seller and buyer communicate via the Internet sites.

Car Tax Expiry

On the other hand, we don’t always think about checking Expiration From Stamp automatic, This is car tax which must be paid annually. To check this, simply enter the vehicle’s license plate on the portalhere or on itrevenue agency. It is actually to be taken into account that the tax associated with the owner And not the car.

Therefore, in the case of used cars, it is up to the person who turns out to be the owner to pay the car tax.Last useful day to make the payment (i.e. the last day of the month following the day of registration). Unless you live in Lombardy. Here, the owner has to pay the tax on the first day of payment (hence the first day of the month following the day of registration).

Read also: Tax bills, after Christmas, you have a few days to apply for a deferment

concrete example

All this is important to avoid paying car tax when it is already due previous owner. If, for example, the car tax expires in January and the sale takes place in the same month, the buyer will have to pay it. Since the car owner will be in the month following the deadline, the deadline for paying road tax.

Read also: Furniture and appliances, a few days to take advantage of the higher reward

On the other hand, if the sale takes place on March 1, the payment will be to the old man her, even if he did not use the car, because he is still the owner as of February 28 (the last day of the tax due date). In short, it’s a good idea to pay close attention to dates.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”

More Stories

Armani opens up about the turning point: “I do not rule out a merger or initial offering.”

Satisfaction with the economic situation grows in 2023 – the last minute

Citroën C3 Aircross: grows to accommodate 7