(ANSA-AFP) - Shanghai, April 25 - US Secretary of State Anthony Blinken called on the US and China to manage...

Nomana is the richest municipality in Marche. This is a photo taken by the Ministry of Finance (Ministry of Finance)...

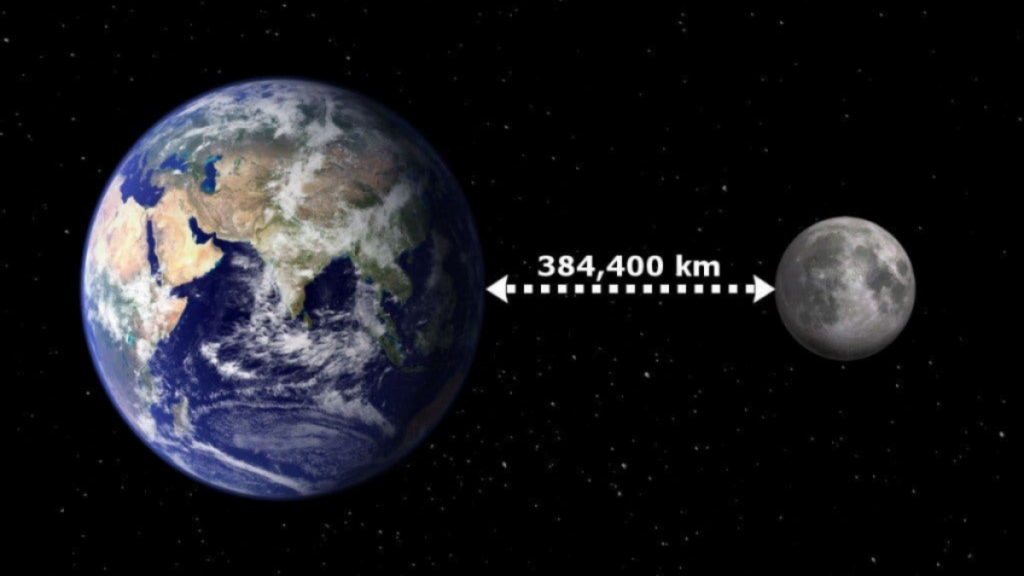

Embark with us on a journey from Earth to the Moon at the speed of light. distance? 384 thousand kilometers...

Disreputable lawyers Nintendo They have now raised their goal Maud GarySomewhat surprisingly, the authors hit Facepunch Studios for copyright infringement...

Forest City, the abandoned city in Malaysia that cost $100 billion.Jungle City: The new $100 billion city is completely abandoned...

The President of the Commission on Constitutional Affairs of the Senate, Alberto Balboni, will be the Rapporteur of the Casellati...

1" Reading 04/24/2024 - Data from the 2023 tax returns relating to the 2022 tax year compiled by the Ministry...

toFederica Banderalli A vague post angers the singer's followers. Cremonini writes in Polish: “Sa fet Gianni? New job to Gianni...

3.8 billion years ago, the planets of the solar system underwent a period known as “delayed intense bombardment”: the reconstruction...

When I went to look at the job postings, someone discovered this Blizzard Works on New open world game It...