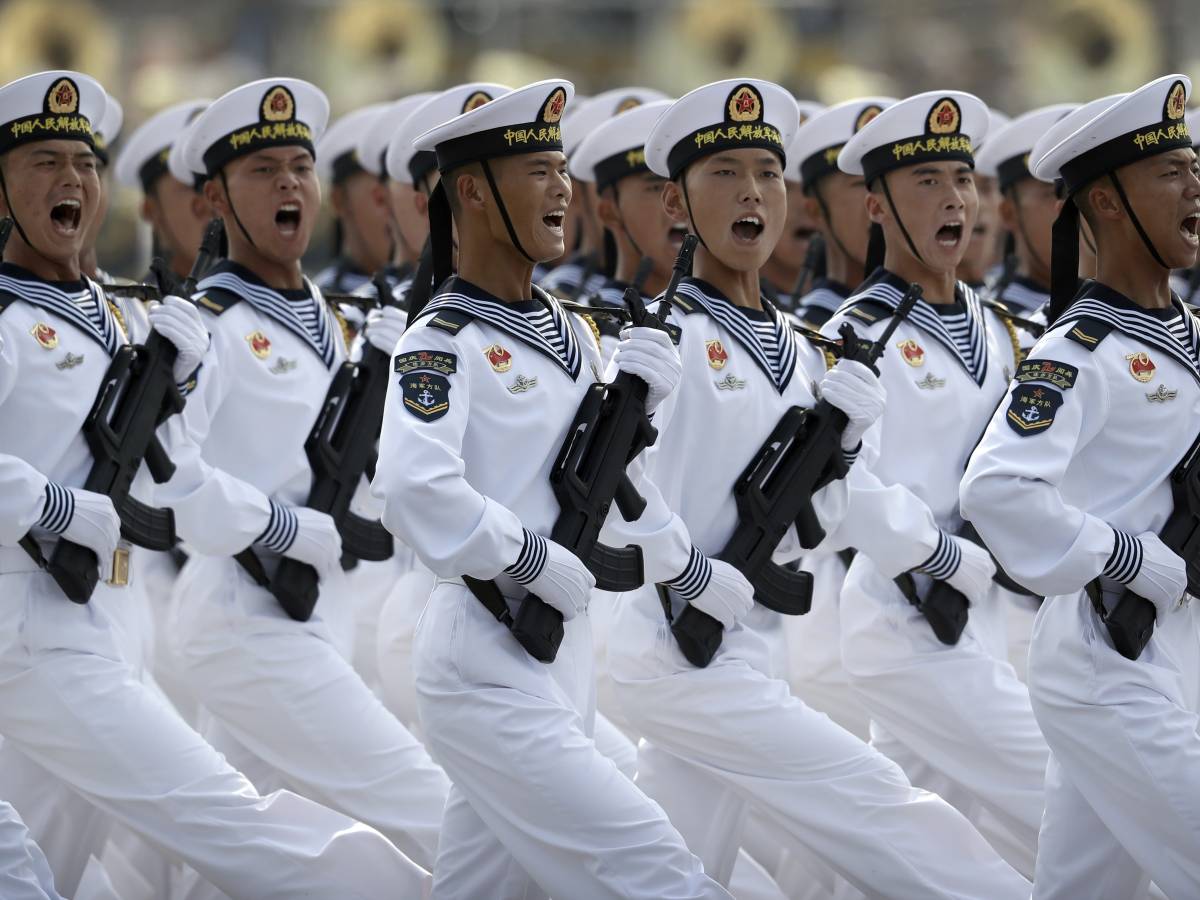

A new one Chinese Outpost A stone's throw from the US is under construction. U.S. The spotlight is on a...

"I'll be with you", Neapolitan Scudetto: Exciting 3 Trailer - Video %26%238220%3BSar%C3%B2+With+You%26%238221%3B%2C+The+Film+Scudetto+From+Naples%3A+The+Trailer+3+%C3%A8+Chilling+%26 % 238211%3B+Video spazionapoliit /04/23/2024/saro-con-te-il-film-scudetto-del-napoli-il-trailer-3-e-chill-video/amp/ Napoli Scudetto movie trailer...

Go into space, stay in Turin and thus discover the secrets of the universe, and also talk about UFOs and...

The Italian League released the calendar for the 35th round of the tournament and revealed the date of the match...

dead announced its collaboration with Microsoft to create a New Quest headset "Inspired by X-Box": It could be a branded...

Mystery surrounds the rumor circulating about the alleged serious illness that will afflict Chechen leader Ramzan Kadyrov. In fact, after...

OffMarco Accion According to the professor, it would be wrong to compete for Europe and not go there if elected....

Happy worker for a lot of money – Depositphotos – jobsnews.itApril and May are months full of holidays: Easter Monday,...

Harley Zuriati, Avari Toy competitor from Friuli Venezia Giulia, is fighting cancer but celebrating her 40th birthday: “Without a uterus,...

Watch the future “collision” between the Andromeda Galaxy and the Milky Way, the video is incredible

Spoiler: It will happen in about 4 billion years! Here's everything we know about the future "collision" between the Milky...