The President of the Commission on Constitutional Affairs of the Senate, Alberto Balboni, will be the Rapporteur of the Casellati...

1" Reading 04/24/2024 - Data from the 2023 tax returns relating to the 2022 tax year compiled by the Ministry...

toFederica Banderalli A vague post angers the singer's followers. Cremonini writes in Polish: “Sa fet Gianni? New job to Gianni...

3.8 billion years ago, the planets of the solar system underwent a period known as “delayed intense bombardment”: the reconstruction...

When I went to look at the job postings, someone discovered this Blizzard Works on New open world game It...

lapare-auto-depositphotos.com-motorzoom.itWashing a car should be a pleasure, more than anything else for a dual concept of beauty and health: but...

You can freely enroll in the first semester of Medicine and Surgery, Dentistry and Prosthodontics and Veterinary Medicine. Without going...

The Meloni government's estimates still fall short of the super bonus costs. After every new negative update, the Minister of...

The Earth has always had a silent companion in the vastness of space: Luna. But what if she's not the...

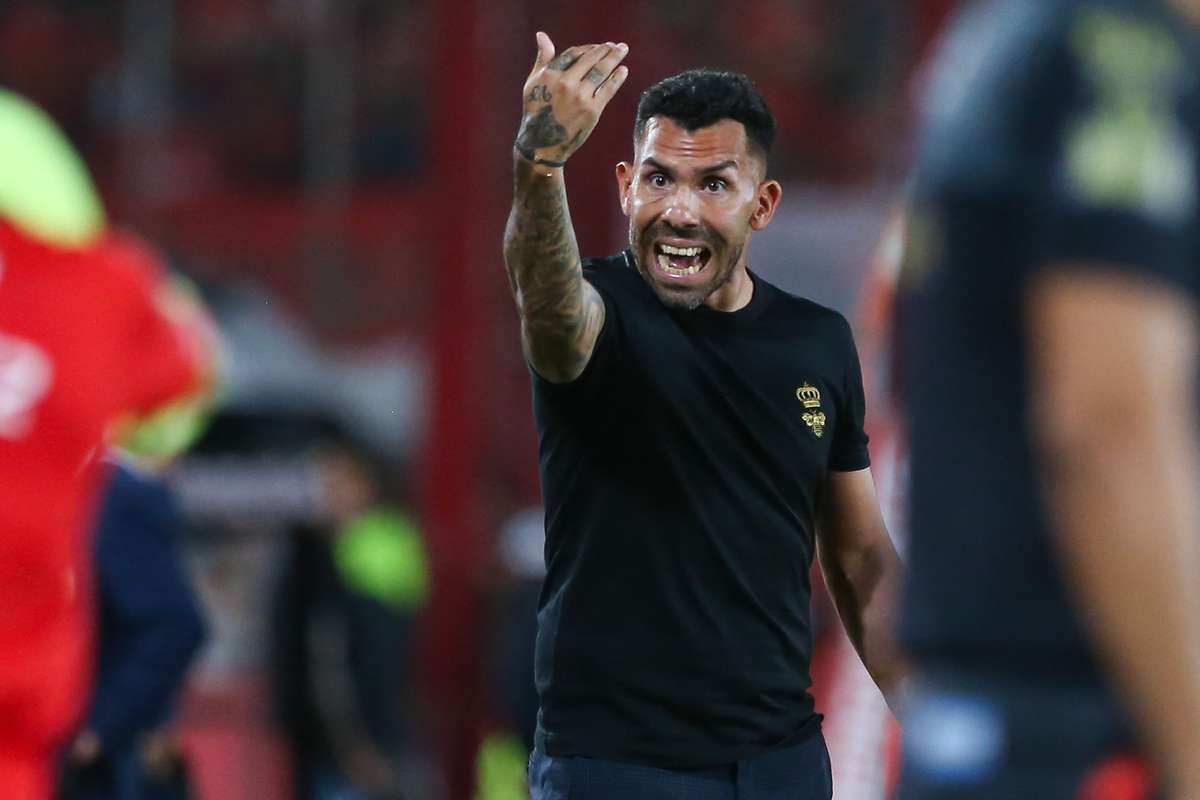

Fear for Carlos Tevez: He is urgently hospitalized due to severe chest painThe former Argentine Juventus player and current Independiente...